AI workflow automation is transforming Shopify accounting faster than anyone expected.

Today’s tools can automatically read receipts, categorize expenses, and forecast cash flow with stunning accuracy. This kind of automation is no longer science fiction—it’s already powering thousands of Shopify stores.

But here’s the catch: AI workflow automation only works when your store and accounting systems are properly synced. The stores seeing real results are the ones with clean, connected data. The rest? They’re stuck with outdated processes and unreliable numbers.

The difference isn’t about having the most advanced tools; it’s about building the right foundation so AI can actually do its job.

AI Is Already Changing Ecommerce Accounting

The conversation about AI in ecommerce has shifted from ‘someday’ to ‘today.’ In fact, 79% of business leaders say AI will be critical to their success.

For Shopify store owners, that means the tools are here now, and early adopters are already saving time and making better decisions.

- AI bookkeeping tools are cutting out hours of manual data entry.

- Forecasting tools help stores plan inventory around seasonal spikes.

- Fraud detection systems catch issues before a human ever sees them.

The promise is compelling, but there’s a catch that most store owners don’t realize until it’s too late.

Why AI Doesn’t Work When Your Data’s a Mess

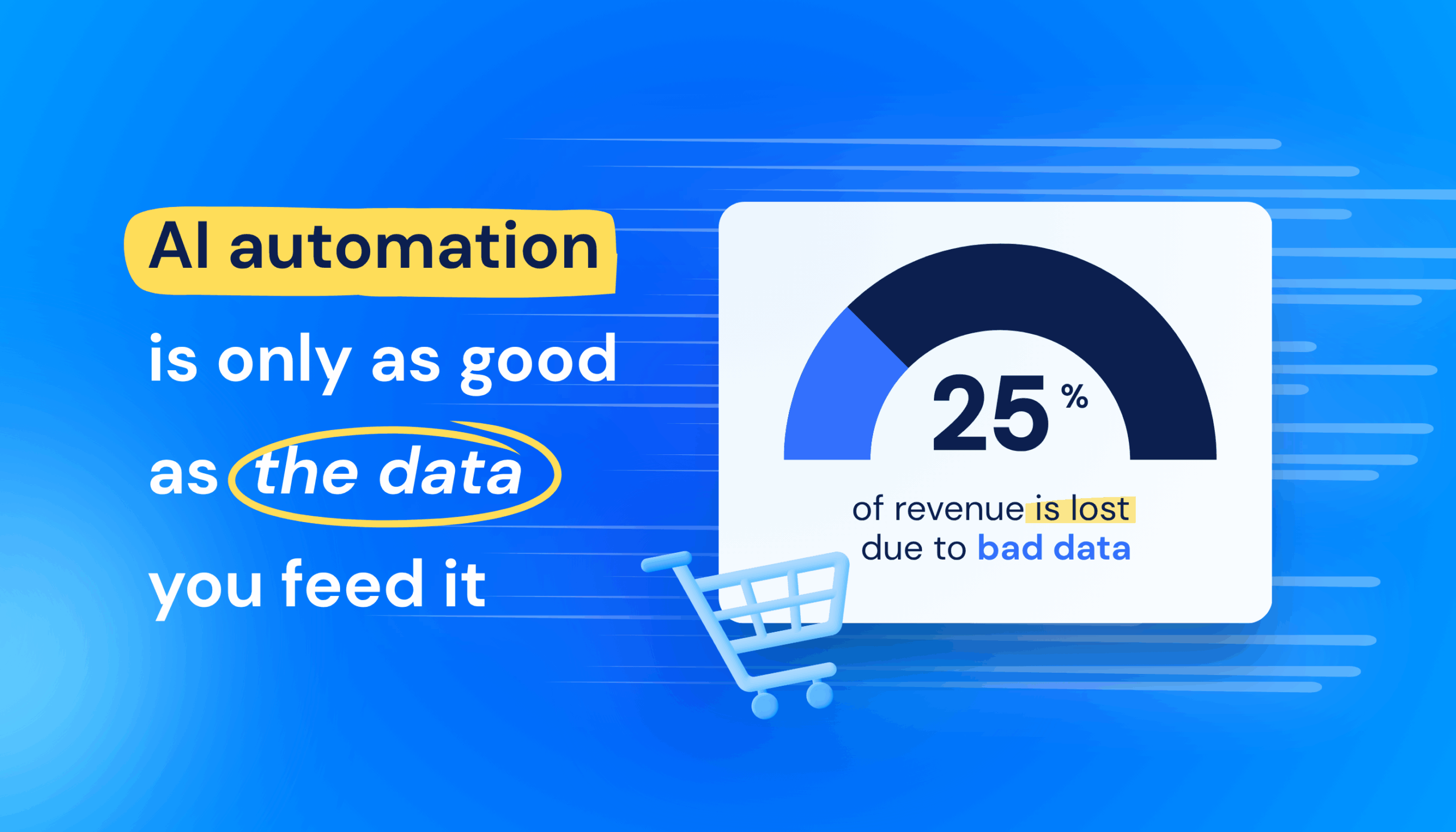

Here’s the truth: AI workflow automation is only as good as the data you feed it.

If your Shopify accounting data is messy, incomplete, or out of sync, AI will not fix it—it will make things worse:

- Small entry errors turn into big, automated mistakes.

- Delayed data blocks real-time insights.

- Missing info means missed opportunities.

It’s the classic garbage-in, garbage-out problem, just moving at the speed of AI.

Disconnected systems are usually to blame. Your Shopify store collects sales data; your accounting software tracks finances, but they operate in isolation. Even the best AI tools can’t work with information gaps.

And the costs are real. According to MIT Sloan, poor quality data can drain up to 25% of your revenue each year. For a store making $500,000 annually, that’s potentially $125,000 lost, just because your systems aren’t talking to each other.

The First Step: Sync Shopify and Your Accounting Tools

Are you wondering how to set up Shopify automated accounting? Start by making sure your Shopify store and accounting platform (like QuickBooks) are syncing automatically and accurately.

Smart ecommerce stores don’t start with AI. Before layering on forecasting, automation, or AI-powered insights, they make sure Shopify and their accounting platform (like QuickBooks) are syncing automatically and accurately.

Think of it like building a house: you need a solid foundation before you can install smart home tech.

In ecommerce accounting, that foundation is seamless data flow. Every order, payment, refund, and fee should sync across systems without manual entry. When your data is flowing, AI tools can actually do their job. Choosing the right Shopify accounting software is an important part of setting up this foundation, as it ensures smooth syncing and compatibility with AI tools.

Here’s how an intelligent system setup works:

Your Shopify Store Handles |

Your Accounting Software Handles |

The Sync Between Them Handles |

|

|

|

When this foundation works properly, store owners often save 10+ hours weekly on manual bookkeeping tasks. More importantly, they get reliable data that makes AI tools actually useful.

How AI Workflow Automation Improves Your Day-to-Day Shopify Accounting

With proper data foundations in place, AI transforms routine accounting from tedious chores into strategic advantages.

1. Smart Document Processing

Instead of manually typing vendor bills and receipts, AI bookkeeping tools can now read these documents automatically. They extract key details like dates, amounts, and vendor names, then categorize everything correctly in your accounting software.

What used to take hours now happens in minutes.

2. Better Forecasting

AI analyzes your sales data to identify seasonal trends and customer buying patterns. This provides remarkably accurate forecasts for cash flow needs and inventory planning.

You can anticipate big purchases (like Black Friday inventory) and optimize stock levels to prevent costly overselling.

3. Built-In Fraud Protection

Advanced monitoring tools learn your business patterns and flag unusual transactions automatically. They can spot duplicate payments, unusual order amounts, or suspicious customer behavior, adding powerful fraud protection.

4. Instant Business Insights

Instead of waiting weeks for monthly reports, AI provides instant visibility into profitability, customer lifetime value, and product performance. This enables faster decision-making about pricing, marketing spend, and inventory investments.

All of this depends on one thing: data syncing between Shopify and your accounting system.

The Hidden Costs of Poor Integration

When systems don’t communicate properly, businesses pay what experts call “hidden taxes.”

The Efficiency Problem

Hours spent on data entry could be invested in growth activities like marketing and customer service. A store processing 100 orders monthly might spend 8+ hours weekly on manual accounting tasks.

At a conservative $25 hourly value, that’s $800 monthly in opportunity cost—money that could fund marketing, product research, or business development.

The Accuracy Problem

Costly mistakes from manual processes, including typos, missed orders, and reconciliation errors, create expensive corrections. These errors compound quickly and often go unnoticed until tax time.

The Opportunity Problem

Missed insights about profitable customer segments, seasonal trends, and optimization opportunities that remain invisible in disconnected data. Without clean data, you’re making business decisions based on incomplete information.

These costs compound quickly and impact every aspect of business growth.

Don’t Let These Accounting Automation Myths Hold You Back

Many Shopify store owners delay automation because of outdated assumptions. Let’s clear those up.

“It’s Too Expensive”

The cost of not automating is typically far higher than the cost of automation tools themselves. When you factor in the financial impact of data errors, lost time, and missed opportunities, professional automation often pays for itself within months.

“Setup is Too Complicated”

Modern integration platforms, like MyWorks, are designed for busy store owners, not IT departments. Most solutions offer guided setup and expert support, getting stores operational within hours rather than weeks.

“My Current Tools Already Do This”

Many basic connector apps provide one-way data transfer that breaks down in complex scenarios like refunds or split payments. True automation requires robust, two-way communication built for real-world ecommerce complexity.

“AI Will Replace My Bookkeeper”

AI doesn’t replace human expertise—it amplifies it. A good bookkeeper with intelligent automation spends less time on data entry and more time helping you make better financial decisions.

But if you need quick answers to accounting questions without wasting your accountants’ billable time on it, you can get quick guidance from the special AI Ecommerce Accounting tool

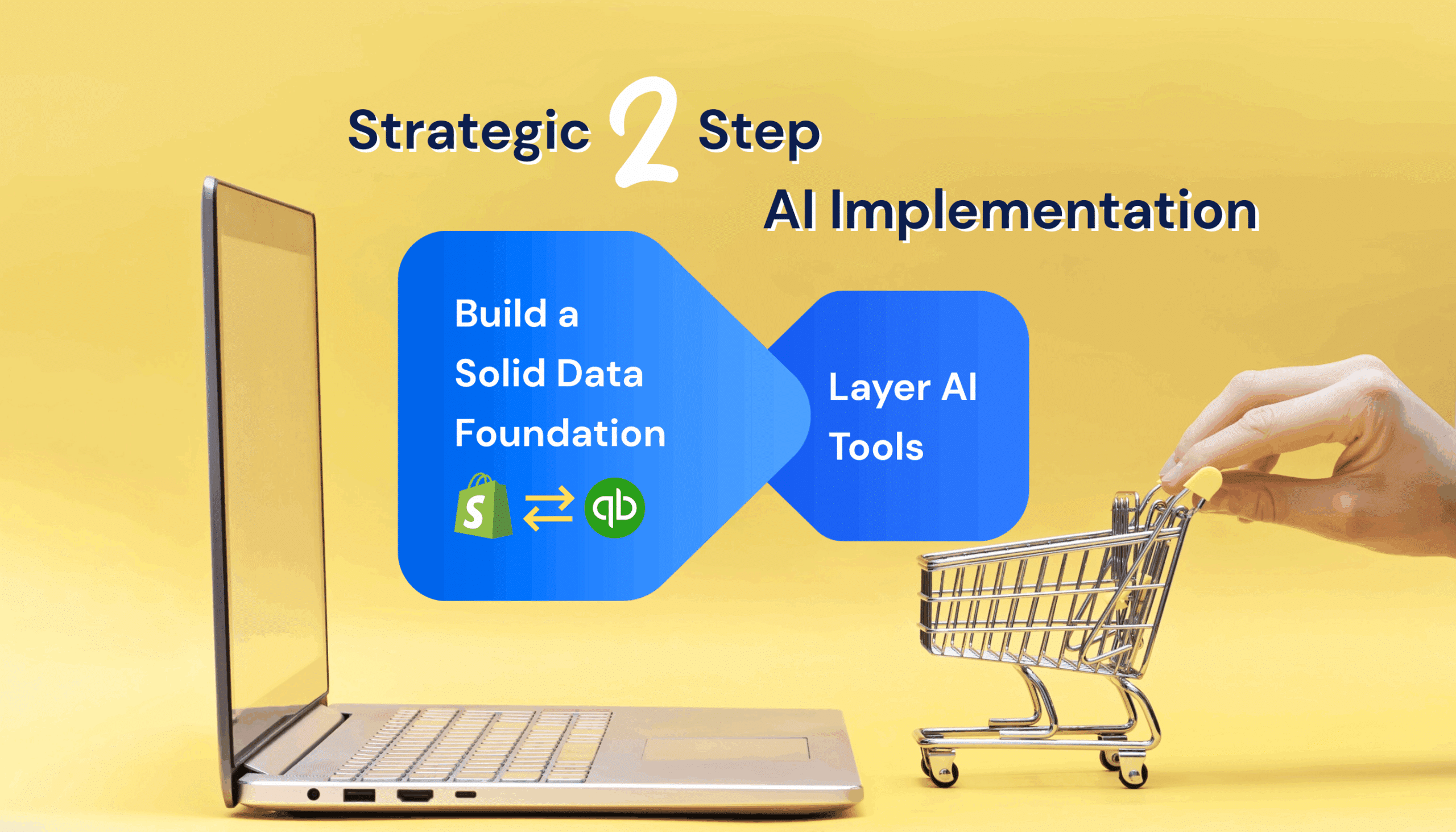

A Strategic 2-Step Approach to Implementation

The most successful stores take a two-phase approach to accounting automation.

Step 1: Build a Solid Data Foundation

Before adding any advanced tools, make sure your systems are synced. That means every Shopify order, refund, payment, and fee automatically flows into your accounting software without errors.

Look for tools that can handle:

- Multi-payment orders.

- Partial refunds.

- Platform-specific fees.

- Tax syncing.

- Inventory updates.

Step 2: Layer Strategic AI Tools

Now you can add tools that do more, like forecasting cash flow, optimizing inventory, or detecting fraud.

These AI workflow automation tools only work if your inputs are accurate. With the right foundation, they become powerful levers for growth.

Preparing for the Future of AI Accounting

The next decade will likely see AI evolve from helpful automation to proactive business intelligence

AI tools will soon:

- Flag compliance risks before they happen.

- Recommend pricing changes in real-time.

- Answer complex financial questions instantly.

This future isn’t about collecting more tools—it’s about building foundations that let AI work effectively. The merchants who prepare now will be positioned to leverage whatever innovations come next.

Ready to Make Ecommerce Accounting Easier?

If you’re spending too much time on bookkeeping or chasing down errors, learn how to set up Shopify automated accounting and start by connecting your store and accounting software the right way. MyWorks Sync automates the flow between Shopify and QuickBooks, so your data stays accurate and up to date.

It’s a simple way to save time, reduce errors, and get your systems ready for more advanced automation.

Want to see how MyWorks Sync fits into your store’s workflow? Book a quick demo to explore the setup and see it in action.

FAQs About AI Workflow Automation for Shopify Accounting

1. What’s the Difference Between Standard Automation and AI Automation?

Standard automation moves data between platforms based on fixed rules, like syncing orders from Shopify to QuickBooks. AI automation builds on that by spotting patterns, making predictions, and flagging anomalies.

2. Should I Set Up Accounting Automation Before Exploring AI Tools?

Yes. AI tools rely on structured, real-time data to deliver insights. Without the right foundation, even the best tools can’t help you forecast, optimize, or spot risks accurately.

3. What Makes MyWorks Different From Other Integration Tools?

MyWorks is built for ecommerce complexity. Unlike basic connectors, it supports two-way syncing, handles edge cases like split payments and partial refunds, and scales with your business, so your Shopify–QuickBooks integration stays reliable over time.

4. Will AI Replace My Ecommerce Accountant?

Not at all. AI handles repetitive accounting tasks, but your bookkeeper still plays a critical role in strategy, oversight, and compliance. With AI, they can focus on what matters: advising you, not fixing errors.