The right software can help you streamline processes and improve efficiency, freeing up time to spend on strategy and scaling your firm.

However, it’s important to make sure you only have the essential tools. Too much unnecessary software just raises your expenses without necessarily improving the quality of your service. If you’re struggling to manage all the different platforms, it might be time to scale back. Software should improve your productivity, not hamper it.

Our guide breaks down all the essential client accounting software on the market. Read on to discover the top tools to consider and their benefits.

Why client accounting software matters more than ever

Recent advances in artificial intelligence, automation, and data analytics mean accounting tools can handle entire accounting processes. Here are some of the benefits you can expect if you make the most of them:

- Efficiency: Automation can perform many of your most time-consuming tasks like data entry and form filing in a few clicks.

- Accuracy: There’s virtually no risk of errors when accounting tools handle all your data entry and calculations.

- Lower costs: You can save a lot of your hiring budget if your software takes care of many labor-intensive processes.

- Better client relationships: Top client management software for accounting firms makes it easier to respond quickly to customers and address all their needs.

- Regulatory compliance: Tools can scan vast amounts of data to find errors and anomalies and uncover potential issues.

- More scalability: The best accounting tools adapt to your firm’s changing needs so you’re prepared for challenges and opportunities at every growth stage.

1. Core accounting software

The accounting software you choose is critical. Only leading providers allow you to automate a full range of processes and integrate with all the other tools you need. Ideally, they should handle all your routine tasks, such as bookkeeping and tax calculations, as well as many aspects of client communication.

Truly standout accounting software like QuickBooks and Xero cater to different industries. That means they provide specialist tools that allow you to solve each client’s unique challenges.

They’re also most likely to have the most innovative solutions. For example, QuickBooks now has an AI assistant that helps you analyze your client’s financial performance and provide insights.

What you should choose depends on your context. QuickBooks is user-friendly making it easier for small teams to fit around their other tasks. Its large ecosystem also makes it a popular choice as you can add other products and tailor the software to your needs. Whereas Xero excels at data analytics, making it the ideal option for firms helping clients with high-level strategic decisions.

2. Accounting syncs

Accounting software can’t always connect directly to other essential software. You may need a sync to share data between the platforms so you can stay up to date.

For example, accounting software doesn’t integrate with ecommerce sites like Shopify and WooCommerce. Firms end up manually entering all the sales and tax data. As online stores usually have a high volume of transactions, this can make routine bookkeeping needlessly complex and time-consuming.

That’s unless you use an ecommerce accounting sync like MyWorks. You can integrate popular platforms like QuickBooks and Xero and then configure the settings. All your client’s data gets mapped to the right places in their accounts without you having to type in a single number.

The exact sync you need depends on your clientele’s industry. Top accounting platforms should have an app marketplace with all the integrations you can use for different specialty tools. Prioritize ones with consistently high ratings and positive reviews to guarantee quality. Some may offer incentives like special plans for firms, referral bonuses, or partnership programs.

3. Time and project tracking

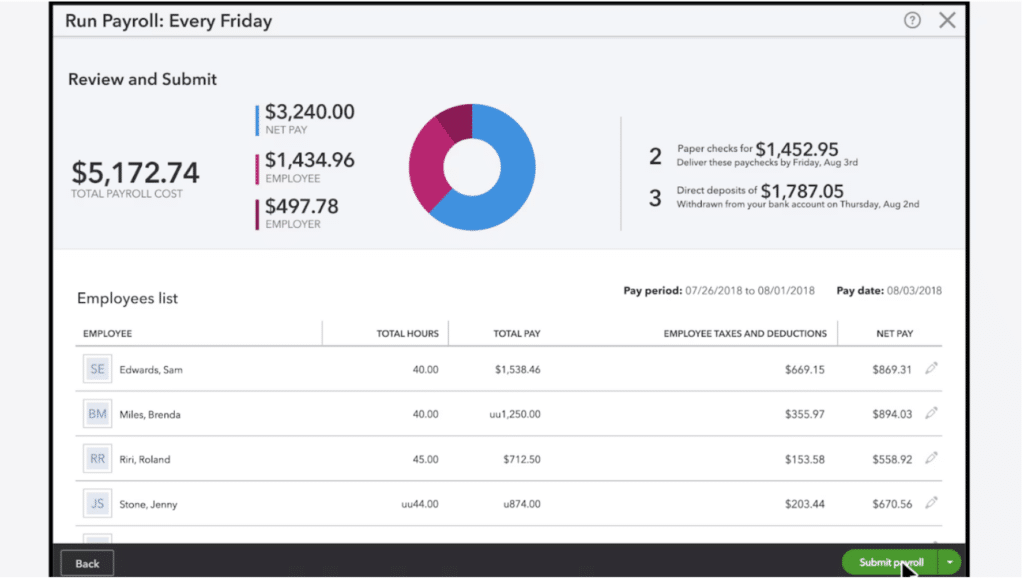

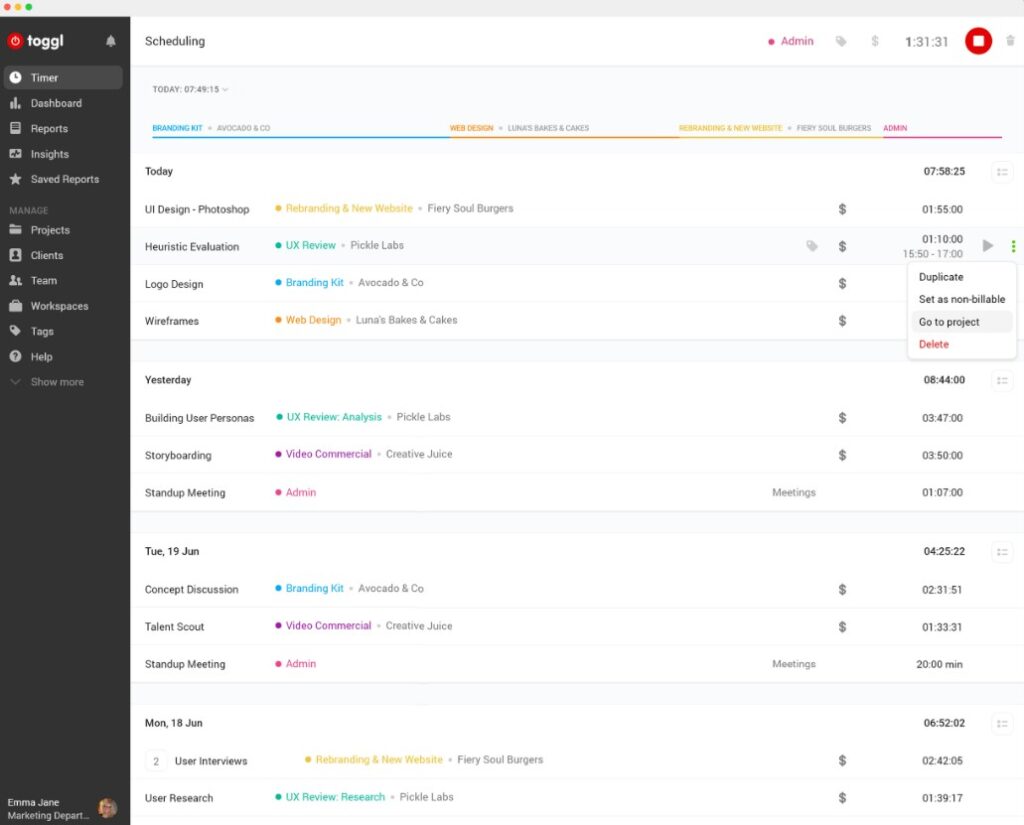

Chances are your accounting firm charges clients by the hour or per assignment. You need to record any time spent or projects completed so you can invoice them correctly.

This calls for flexible and intuitive tracking software. All your staff have to do is switch on a timer built into their browser, and it monitors how much time they spend on different tasks. Afterward, the tools automatically convert all the billable hours and projects worked into invoices.

The benefits go beyond recording hours correctly. As you can see how long tasks are taking, you can easily spot any inefficiencies in your processes. For instance, you might spot that certain software is eating up a lot of your staff’s time.

Many accounting platforms have time and project trackers included in their features. However, you might need to upgrade to access them. Toggl and Harvest both offer free basic plans you can use if you’re on a tight budget.

4. Project and practice management

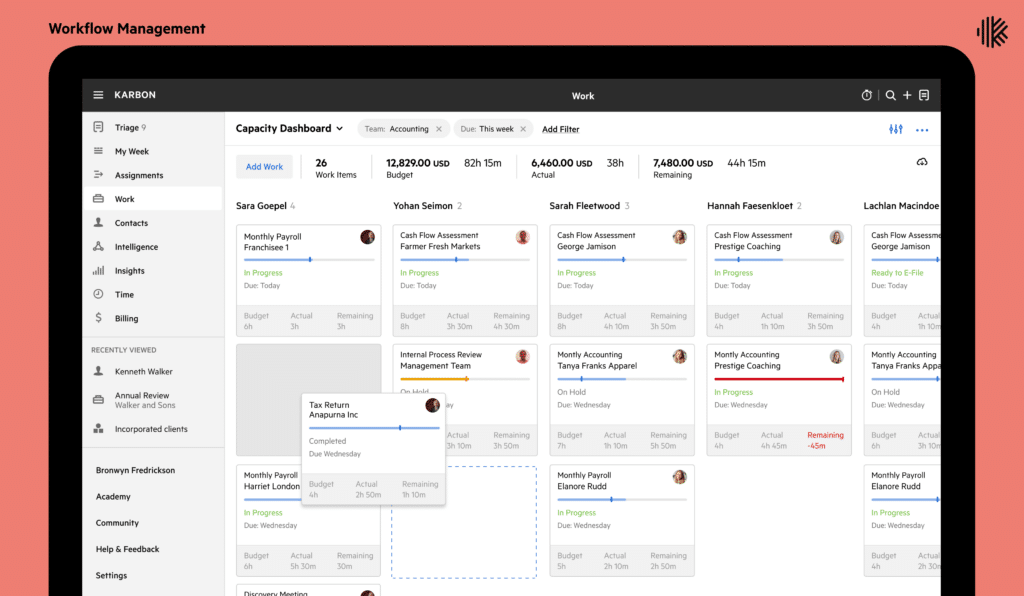

Organizing your workflow becomes easier with project or practice management software. These tools allow you to map all your processes and share them with staff and clients. Accounting firms can use these to:

- Create standardized workflows

- Assign tasks to staff with instructions and deadlines

- Set deadlines with checklists

- Provide information on how to complete tasks

- Estimate the time needed

- Monitor the progress of assignments

- Communicate with team members over issues

The software can essentially act as your hub. By integrating it with all your other software, you create a centralized place where staff can check their assignments and access all the necessary tools and information.

Solutions like Karbon are specially tailored to the accounting industry. They make it easy to create workflows around common bookkeeping practices and integrate with all the popular finance solutions.

However, nothing’s stopping you from using general solutions your clients might be more familiar with like ClickUp and Zapier. Top providers are highly customizable so you can still develop workflows to suit your firm.

5. Proposal management

As your accounting firm grows, you’ll need to create and distribute more client proposals. The challenge is keeping track of all these documents when you might have dozens of new prospects.

Let proposal management software be your personal assistant. These tools provide best practice templates you can use to draft your proposals. After you’ve sent them to clients, the software automatically updates you when the document is opened, viewed, and signed.

Proposal management software should include support for electronic signatures so you don’t need to send paperwork back and forth. This includes the option to type, write, or upload images. Clients can then sign proposals in a way that makes them feel more comfortable and secure.

Look for ones like PandaDoc that let you customize all your templates. This can help you develop a consistent brand and stand out among the competition.

6. Customer relationship management (CRM)

Growing firms often struggle to track all their client information. Staff might find themselves cramming before meetings to remind themselves what was said in previous check-ins and messages.

CRMs mean you’re always fully up to speed with clients whenever you contact them. It stores all data about all your interactions with them as you work alongside them. All your team has to do is click on profiles to reveal the most pertinent information.

With CRMs, accounting firms can also:

- Automate emails using templates and fields

- Set reminders for follow-ups

- Schedule meetings and check-ins

- Monitor prospect pipelines

- Analyze their customer base

- Measure client engagement

Two of the biggest CRMs on the market are Zoho and HubSpot. They both have extensive customization options and a range of integrations with popular platforms. If you only have a few clients, you can rely on their free basic plans while you grow.

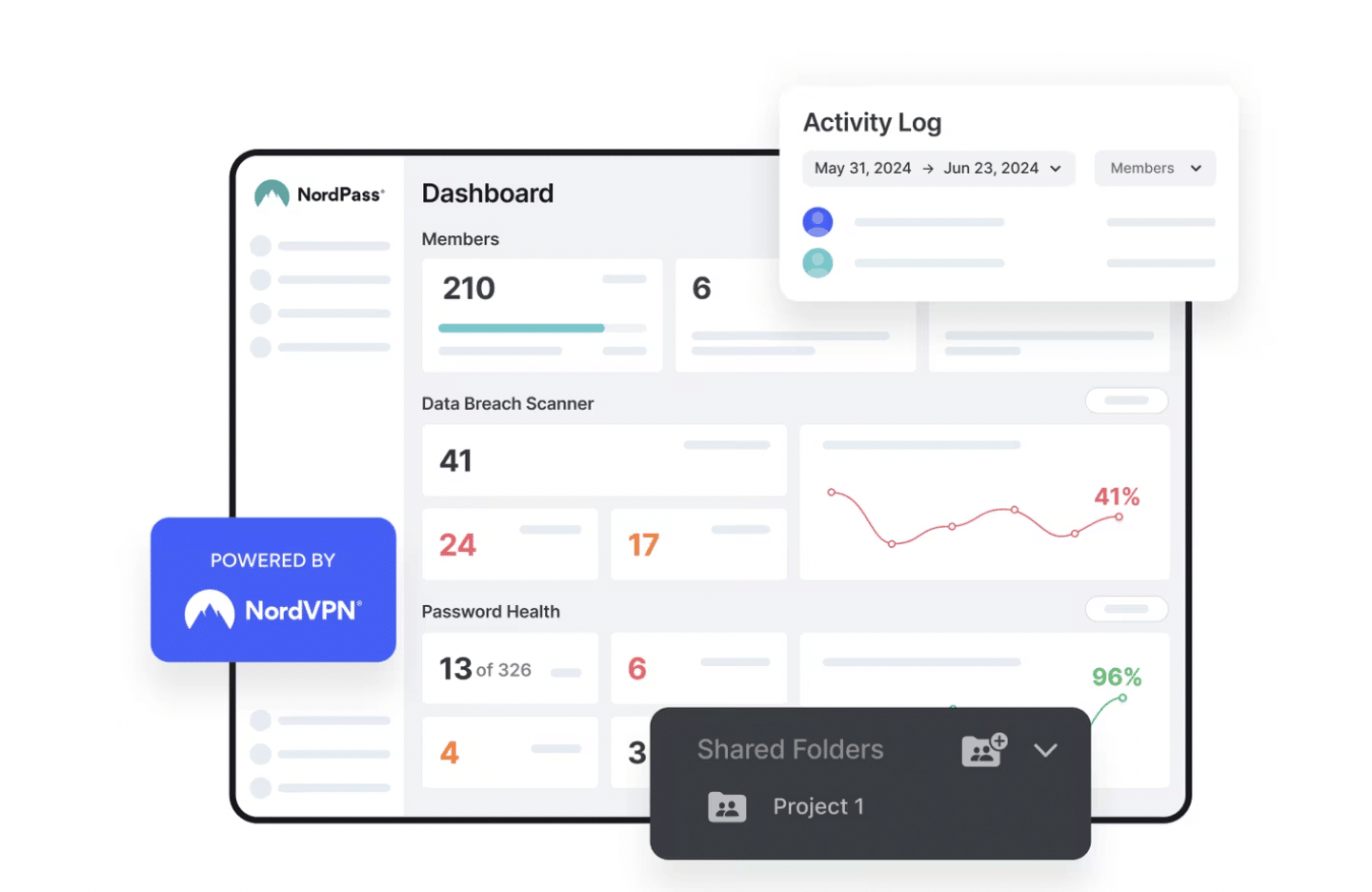

7. Data security

The finance industry experiences the most breaches worldwide. Hackers can use your firm’s sensitive data to commit fraud or gain access to accounts.

Robust security software can help protect your system and maintain client trust. In fact, some of them are probably looking to see what protocols you have in place. You can also stay compliant with stringent international regulations like the GPDR and CCPA.

Many breaches are the result of human error. That’s why you should prioritize security software that offers secure password management, like NordPass. These store all credentials on your centralized system so nobody needs to write them down or share them. Everyone gets access to the software they need to perform their jobs well without leaving your firm open to risks.

8. Tax research

Tax requirements are constantly changing at both the local and national levels. Researching these can require a lot of your time. If you’re handling international customers, this only adds to the complexities.

The right software can update you about regulatory changes that might otherwise slip under the radar. They also act as a kind of encyclopedia of tax law, providing up-to-date answers to all your questions. That means you won’t have to keep clients waiting while you research more specific or unusual cases.

Thomson Reuters Checkpoint provides services like these across a range of areas, such as accounting and payroll. They can help you with both routine queries and more strategic, high-value tasks.

For a less conventional tool, consider the new TaxGPT. The makers trained this AI model on extensive tax laws so it can give highly specific and accurate answers. Users can also upload their documents to the system to get assistance completing them.

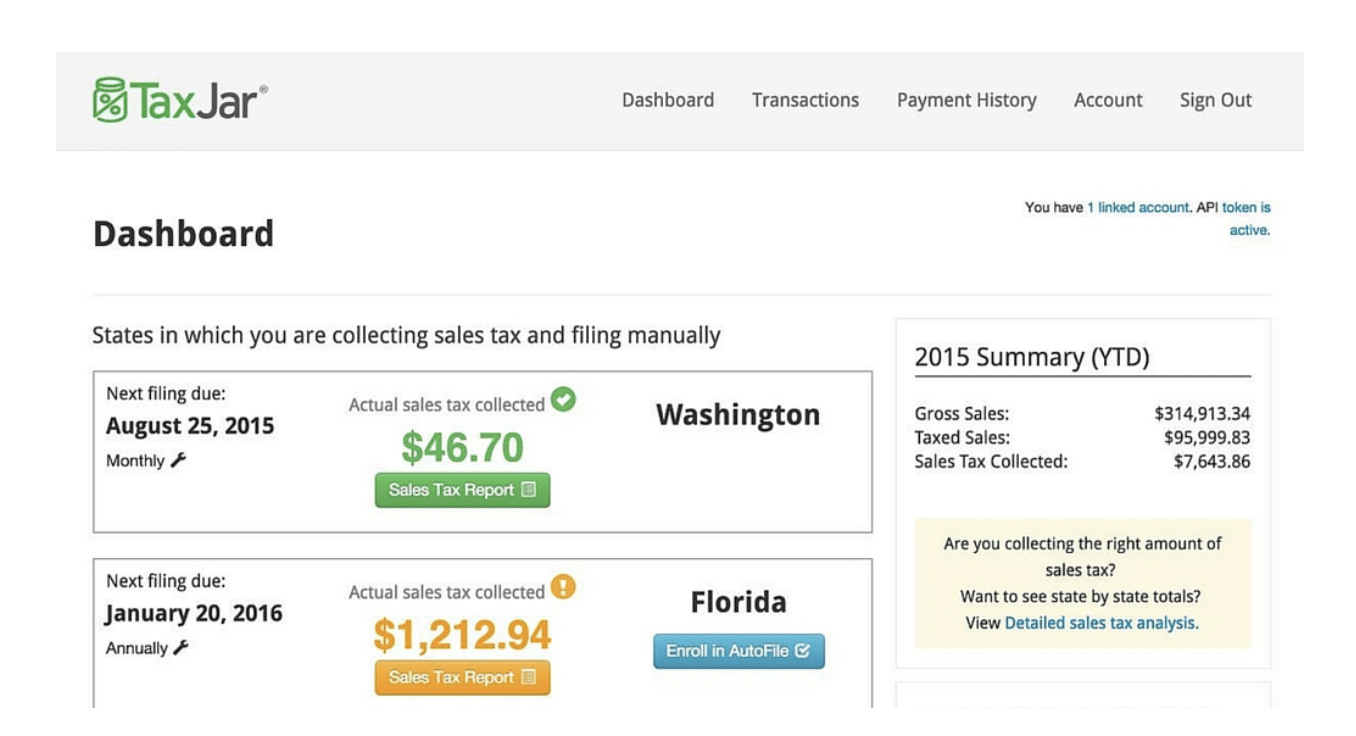

9. Sales tax automation

All jurisdictions have their own version of sales tax. If you manage clients who operate across states and countries, you can pour hours into checking and calculating all these fees.

Sales tax automation collects, calculates, and files all these fees for you. All you have to do is review the information and cross-check it against other accounts. Not only does it manage the bulk of the work, but it also lowers the risk of errors.

Leading solutions like TaxJar and Avalara make it easy for firms to review customers. You can invite client companies to join and monitor them via the dashboard.

Both platforms also include features to assist you with ongoing tax compliance. For example, you can check whether clients meet the exemption criteria in specific locations. Wherever they operate, you can get reminder emails about upcoming filing deadlines.

How does your client accounting software all fit together?

When choosing your client accounting software, there are many factors to consider. However, your key focus should be on integrations. The more solutions that connect seamlessly together, the easier it is to manage your clients’ accounts.

That’s why it’s best to consider your client’s accounting software as a whole. How do they fit together? Are there any gaps? You can create a tech stack that not only makes you more efficient but also allows you to scale and build your client base.

| Guarantee smooth integrations for all your ecommerce clients

MyWorks offers a highly configurable sync between your clients’ online stores and popular accounting platforms, QuickBooks and Xero. |