Staying on top of your books is crucial for business success. It’s the only way to get a clear view of your financial performance and maintain compliance with all the relevant tax laws.

That means recording every transaction —- no matter how big or small — as journal entries in your ledger.

Managing finances can be particularly challenging for online stores. You have to account for a variety of transactions across different channels and payment gateways. Depending on your industry and location, you probably also have to apply different taxes.

That’s why we’ve created this guide: How to do journal entries in accounting, especially for ecommerce businesses. Read on to learn the fundamentals and all the best practices for online stores.

What is a journal entry in accounting?

A journal entry in accounting is a record of a financial transaction made by your business. You document these in your general ledger.

Journal entries for ecommerce typically include:

- A brief description

- The order number

- The date of the transaction

- Any accounts affected

- The debit and credit amounts

It’s standard to use double-entry accounting when you write journal entries. That means you should write every transaction as a credit in one account and a corresponding debit in another. A simple example is a sale — the goods you sell result in a debit to the cost of goods sold and a credit to inventory.

What makes ecommerce accounting so complex is that even a basic sale usually involves multiple transactions. Your entries must account for the payment, tax, and any shipping costs at a minimum.

A journal entry example for ecommerce

Say a customer buys a product from your store using a credit card. Here’s what the journal entry in your ledger might look like:

| Date | Description | Account | Debit | Credit |

| 07/01/2025 | Sale of RapidZap microwave oven

(Order: 1065) |

Accounts receivable | $115 | |

| Sales revenue | $100 | |||

| Sales tax payable | $5 | |||

| Shipping payable | $10 | |||

| Cost of goods sold | $50 | |||

| Inventory | $50 |

This journal entry is an example of double-entry accounting so every credit has a corresponding debit to keep the book balanced.

For example, the store credits itself with $115 for the sale, tax, and shipping. As the customer paid via credit card and they’re still awaiting the money, they add a debit to Accounts Receivable.

As you can see, both the debit and the credit columns add up to $175. That’s how the business knows they’ve accounted for every transaction and recorded the sale correctly.

Different types of journal entries

There are several types of journal entries. Ecommerce businesses are likely to use all of them at different points in their accounting cycle.

- Simple: This type of entry only involves two accounts, one for the debit and one for the credit. Online stores might use them to record basic payments for utilities or subscriptions.

- Compound: As the name suggests, this type of entry involves multiple accounts and transactions. The example given in the section above would be typical for an ecommerce business.

- Closing: You use these entries to transfer balances from temporary accounts to permanent ones at the end of an accounting cycle. Essentially, you reset your books.

- Adjusting: This type of entry gives you a chance to correct or update your books before you close them for the period. They help you ensure any financial statements are accurate.

- Opening: After you’ve recorded a closing entry, you write an opening one to carry over any assets, liabilities, and equity from the previous period. By doing so, you set the balance for the new period.

- Reversing: If you use accrual accounting, you may document transactions before they physically occur. You may enter a new period while waiting for the transfer. In this case, you need to record an entry to ensure you don’t accidentally duplicate the expense or payment.

- Transfer: This entry reflects any financial changes within your own accounts. A common example is how an online store might record a transfer from their PayPal to their own bank.

Why journal entries matter in ecommerce accounting

Journal entries are the building blocks of ecommerce accounting. Without these records, businesses would struggle to create accurate financial statements.

All these statements give you a clear view of your performance. You use the information on them to inform major decisions and gauge your progress. Statements can also indicate potential issues like overspending or declining profits.

If you’re not recording transactions properly, you lose all these insights. You may miss out on opportunities or overlook issues until it’s too late to course correct.

Keeping accurate records is especially critical for ecommerce businesses. Stores must track a high volume of transactions across various channels and payment gateways. They need a broad overview of their financial activities and a detailed breakdown to analyze specific areas of the business.

Take your inventory management for example. You need to understand all your costs related to storage, shipping, and waste to decide what’s best to stock.

Another major factor is compliance. Depending on the location and international sales activities of your business, you might have to pay a range of different taxes including VAT, and customs duties. Recording all these details in your journal entries helps you ensure timely and precise tax payments, reducing the risk of penalties.

How to write a journal entry in accounting

It’s easier to write journal entries when you have a process. Here are the steps ecommerce businesses can take to record transactions:

Step 1. Identify the transaction

The first step is deciding what type of transaction has taken place. In ecommerce, that could be anything from a sale or bill to a supplier payment.

Differentiating between all the transactions you handle is important. You can tell more easily which accounts you need to debit and credit. For example, online stores need to make a distinction between product sales and gift cards in their journal entries. Vouchers represent a liability rather than immediate revenue until the customer uses them to pay for goods or services.

Step 2. Determine the affected accounts

Once you’ve identified the transaction, decide which accounts it impacts. There are five main categories in accounting:

- Assets: Any physical or non-physical resources your business owns. Aside from cash, ecommerce stores usually have inventory and equipment.

- Liabilities: Anything your store owes, such as taxes and bills. Ecommerce stores also have to remit the payment for shipping and delivery for their partners.

- Expenses: All of your outgoings, including the cost of goods, utilities, and payroll.

- Revenue: The income you generate from any business activities. While that’s mostly sales for ecommerce businesses, you have to account for any offers, discounts, and subscriptions.

- Equity: Any stake you or other shareholders have in the company.

Each journal entry must involve accounts from at least two of these categories. However, it’s likely to involve several.

Businesses should create and refer to a Chart of Accounts (CoA) to make this task easier. The CoA details all the accounts you use and assigns them a unique code. It essentially acts as a framework for your journal entries. You should be able to see which ones you need to use for the transaction at a glance.

Step 3. Record the debits and credits

Now you know which accounts to include, decide whether you need to debit or credit them and by how much.

Visualizing the cash flow can help you with this stage. Say you use a shipping company and add $10 to each sale to account for their fees. You accept the payment from the customer, but that money doesn’t belong to your business.

That means you need to debit Accounts Receivable (assets) and credit Shipping Payable (liabilities). Basically, you record that your business took in cash but also increased the money it owed. Create a brief description or an order number with every journal entry for your reference. Many ecommerce and accounting software solutions can be configured to automatically generate journal entries with standardized descriptions or order numbers. Integration tools like MyWorks can help streamline this process by syncing data between your ecommerce and accounting platforms. This makes it easier to cross-check and amend your books.

The best strategy is to keep it brief. If you’ve sold an item with a long name, include as much information as you need to identify the product. You should be able to quickly skim the page and find the details you need.

Make sure you assign the right value to every aspect of the transaction. While there may be one transfer, it’ll include components like the tax, shipping fees, and any discounts.

Step 4. Add a reference

Create a brief description or an order number with every journal entry for your reference. Many ecommerce and accounting software solutions can be configured to automatically generate journal entries with standardized descriptions or order numbers. This makes it easier to cross-check and amend your books.

The best strategy is to keep it brief. If you’ve sold an item with a long name, include as much information as you need to identify the product. You should be able to quickly skim the page and find the details you need.

How to manage journal entries for ecommerce with popular accounting software

It’s only possible to take a DIY approach to bookkeeping when you start out. As your business grows and your sales increase, recording every transaction can become unmanageable. You’ll also need the expertise of a qualified accountant to maintain accuracy and compliance.

Ecommerce businesses can streamline bookkeeping with leading software like QuickBooks and Xero. They provide consultancy services and automate many aspects of the process including:

- Tracking and recording transactions

- Calculating taxes and fees

- Generating different types of journal entries

- Using these entries to create financial statements

- Reconciling accounts

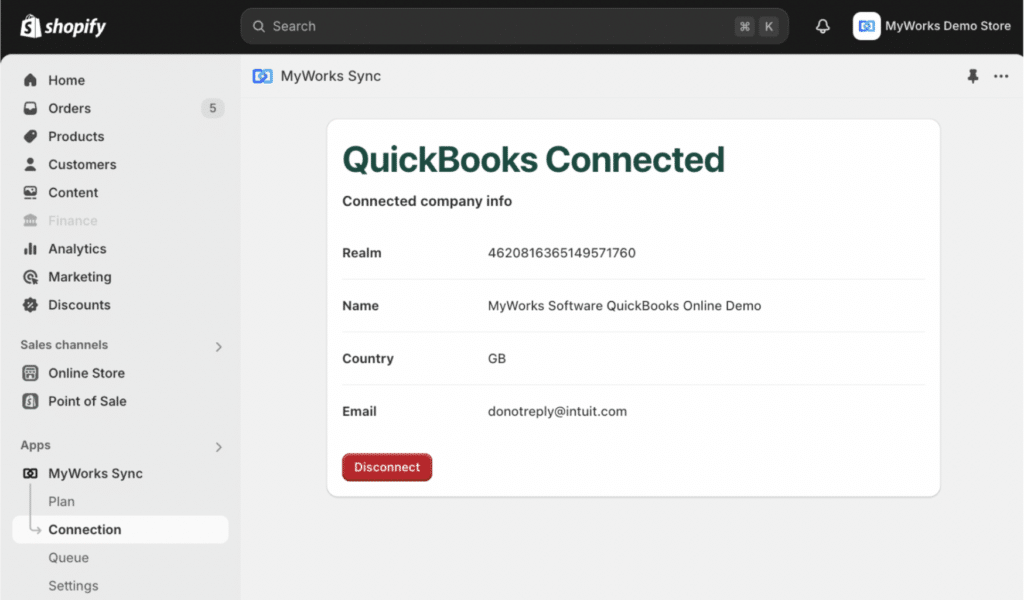

All you have to do is connect your ecommerce site to your accounting software and configure the settings. Use a sync like MyWorks to let the two platforms share all your sales, tax, and inventory data in real-time.

Your system can then automatically create journal entries. As a transaction occurs on your ecommerce site, MyWorks syncs this data with QuickBooks or Xero. The accounting software uses this information to record the transaction, categorize it into the right accounts, and update your records.

Whenever you like, you can log into the system to review these entries and generate statements.

Do everything by the book without looking at a single page

Journal entries are a fundamental part of ecommerce accounting. There’s no better way to record all your online store’s complex financial activities.

While it’s helpful to understand journal entries, you no longer need to manage them yourself. Ecommerce accounting software can handle most aspects of bookkeeping. You can maintain accurate financial records and maintain compliance without burying yourself in paperwork.

| Never lose track of payments again

MyWorks syncs all your data between popular ecommerce and accounting platforms so your books are always accurate and up to date. |