With over 430 million users worldwide, PayPal is a must-have for ecommerce businesses. Supporting this payment platform can help online stores stay competitive by catering to a global market.

Manually entering PayPal transactions into QuickBooks is time-consuming. Unless you’re very careful, it can also lead to discrepancies, which can cause errors with customer orders or taxes. That’s why it’s essential to connect PayPal to QuickBooks using an app.

Here’s exactly how to connect PayPal to QuickBooks, whether you use the Online or Desktop version — in just five simple steps.

What You Need to Link PayPal to QuickBooks Desktop or Online

Before you can connect PayPal and QuickBooks, set up the following:

- A PayPal Business Account

- QuickBooks Online or Desktop

- A stable Internet connection

You’ll need administrator access to both platforms to log into the accounts and authorize all the changes.

How to Connect PayPal to QuickBooks Desktop or Online in 5 Steps

Connecting PayPal to QuickBooks is straightforward and takes less than an hour to set up. However, there are steps you should take to achieve optimal performance and avoid issues.

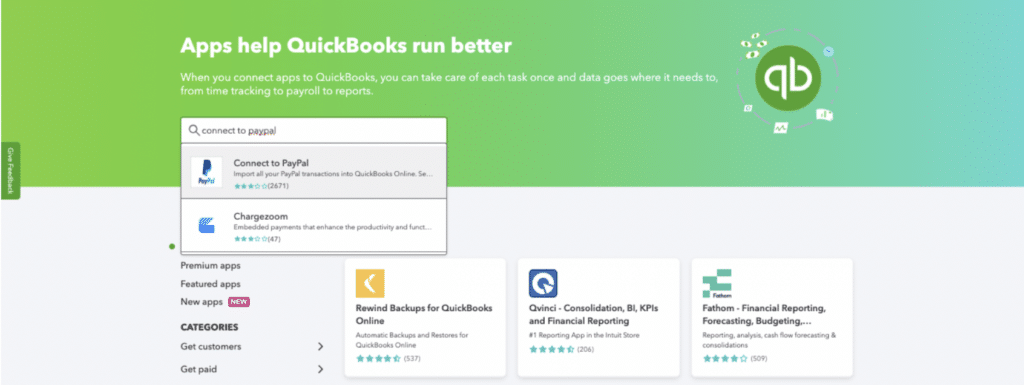

Step 1: Download the PayPal Integration

If you haven’t already, log in to your QuickBooks account. Go to ‘Apps’ and then ‘Find Apps’ in the menu. Search for ‘Connect to PayPal’ to find the integration.

Click on the title to open the QuickBooks app marketplace in a new window. Then, locate the green ‘Get app now’ button in the top left corner and click on it.

Step 2: Sync Your PayPal and QuickBooks Accounts

QuickBooks will ask you to log into the PayPal account you wish to connect. Simply enter your credentials and follow the prompts.

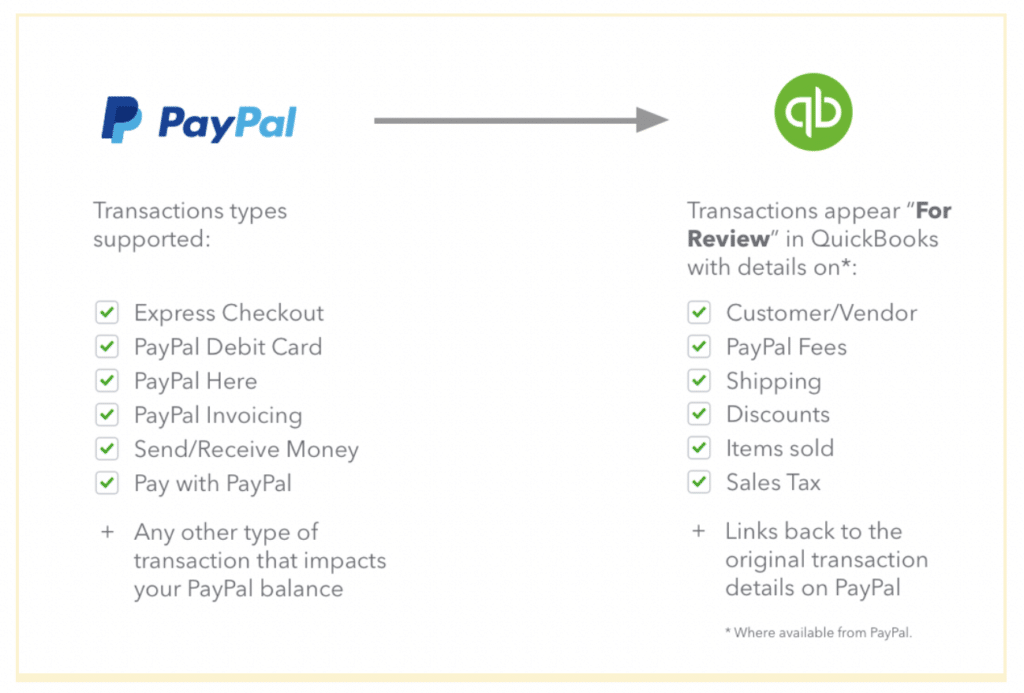

Once you’ve connected, QuickBooks will automatically retrieve all your PayPal account details. It not only syncs your transactions but also any fees, withdrawals, and deposits.

Tip: syncing payment data directly into QuickBooks minimizes reconciliation issues and saves hours of manual entry each month. MyWorks’ QuickBooks integration connects your full ecommerce store (Shopify or WooCommerce) with QuickBooks — including every PayPal transaction.

Step 3: Review and Select Transactions

Before QuickBooks syncs transactions to your account, it lets you check them. Uncheck all the boxes you don’t want to add to your books.

QuickBooks doesn’t sync temporary holds or releases by default. You have to enable these via the settings later.

You can select a data range for a historical sync. If you choose the wrong time frame, you need to disconnect your QuickBooks and PayPal accounts and set them up again.

Step 4: Check the PayPal App

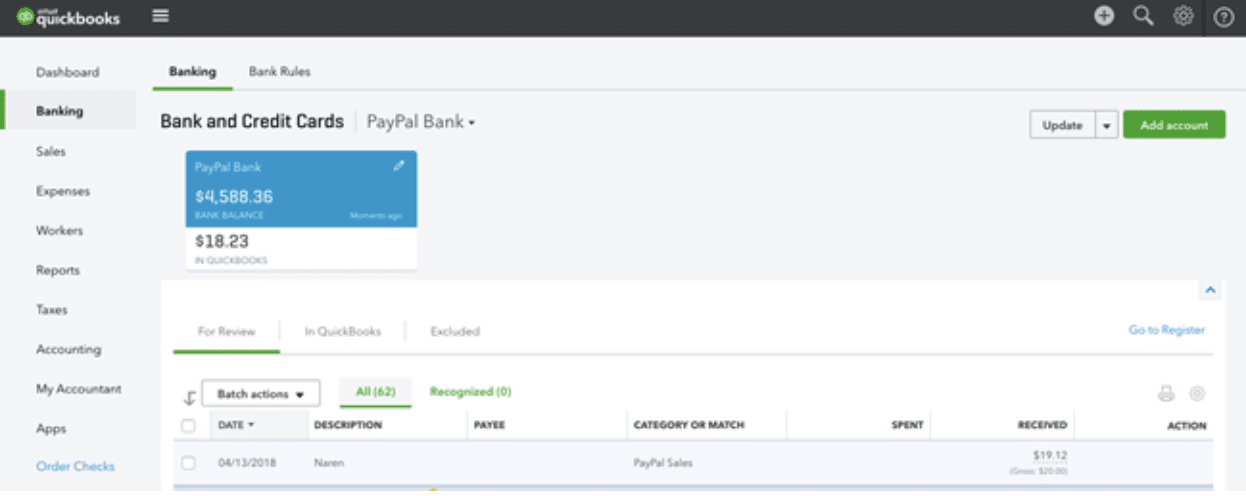

Now you’ve connected the accounts, PayPal should appear in QuickBooks. Go to ‘Banking’ in the menu bar and you should see your balance. Don’t worry if the amount is incorrect — QuickBooks only syncs every three hours.

Check your transactions to ensure they match. The time in the blue PayPal Bank box shows how long ago the platforms synced and whether they should be up to date.

Step 5: Configure Settings

To customize your PayPal integration, go to ‘Transactions’ and then ‘Bank transactions’. You can edit all of the sections to decide which information to sync and what notifications you’d like to receive.

Tips for Managing Your PayPal QuickBooks Integration

To get the most out of your PayPal QuickBooks integration, follow these best practices for smooth syncing and accurate reporting:

1. Keep your software up to date.

PayPal and QuickBooks release frequent updates. Keeping both platforms current helps ensure that your integration runs smoothly and supports the latest features.

2. Reconcile your accounts regularly.

Use the QuickBooks reconciliation tool to compare PayPal transactions with your accounting records. This helps you catch duplicates, missing entries, or sync issues. Aim to reconcile at least once per month.

3. Limit account access to trusted users.

If you’re managing a team, make sure only authorized users can access your QuickBooks and PayPal accounts. This minimizes the risk of manual errors or incorrect settings during the sync.

4. Connect all your ecommerce platforms.

While connecting PayPal to QuickBooks is a great start, syncing your full ecommerce stack — including WooCommerce or Shopify — ensures your sales, inventory, and payments stay aligned. With MyWorks, you can map all your data and automate the sync process across your store, PayPal, and QuickBooks with full customization.

Make the Most of All Your Ecommerce and Accounting Apps

Offering PayPal at checkout is essential for global ecommerce. But the real challenge is syncing those transactions across your store and your books, especially if you use QuickBooks.

Using apps like Connect to PayPal by QuickBooks makes it easy to view and manage your transactions in one place. You’ll get automatic syncing for payments, fees, refunds, and more.

But if you’re looking for a more advanced PayPal integration with QuickBooks, MyWorks gives you full control. Whether you’re using QuickBooks Desktop or Online, you can:

- Sync PayPal transactions from Shopify or WooCommerce.

- Avoid duplicates with smart transaction mapping.

- Customize how your sales, fees, and taxes flow into QuickBooks.

Discover which MyWorks plan is best for your business.

FAQs About Connecting PayPal to QuickBooks

1. How Much Does PayPal Charge for QuickBooks?

There are no additional fees for using the Connect to PayPal app to sync with QuickBooks. However, PayPal’s standard transaction fees still apply when receiving payments, typically 1.9% to 3.49% + a fixed fee per transaction, depending on the country and payment method. Find out more about PayPal’s merchant fees here.

2. Can I Connect Multiple PayPal Accounts to QuickBooks?

Yes. In QuickBooks Online, go to Transactions > Bank transactions, then click Link account. You can repeat this process to connect multiple PayPal accounts, one at a time. Each account will appear as a separate bank feed, so you can track and reconcile them individually.

3. Can I Connect PayPal to QuickBooks Desktop?

Yes, you can connect PayPal to QuickBooks Desktop. Note that some versions of QuickBooks Desktop are being discontinued, so you may need to upgrade to support the integration.

4. What Should I Do if PayPal isn’t Syncing With QuickBooks?

If PayPal transactions aren’t syncing properly:

- Go to Banking > Linked Accounts, and click Update next to PayPal.

- Make sure you’re using the correct PayPal login (must be a business account).

- Check for alerts in QuickBooks — sync failures often appear as error messages.

- If issues persist, disconnect the PayPal feed and reconnect it from scratch.