70% of consumers say the choice of payment methods influences where they shop. In other words, if your WooCommerce payment gateway isn’t fast, flexible, and easy to use, you’re losing revenue at checkout.

In this guide, we’ll show you how to choose, set up, and manage WooCommerce payment gateways — from the best options to advanced setup tips that keep payments flowing and your store running smoothly.

How Do WooCommerce Payment Gateways Work?

A payment gateway is software that enables you to accept credit and debit card purchases from customers. Ecommerce stores mostly use an online checkout portal.

Although they serve similar functions, a payment gateway is different from a payment processor. The payment gateway collects and verifies purchase information before connecting the customer to the merchant account. However, it’s the payment processor that initiates the transfers.

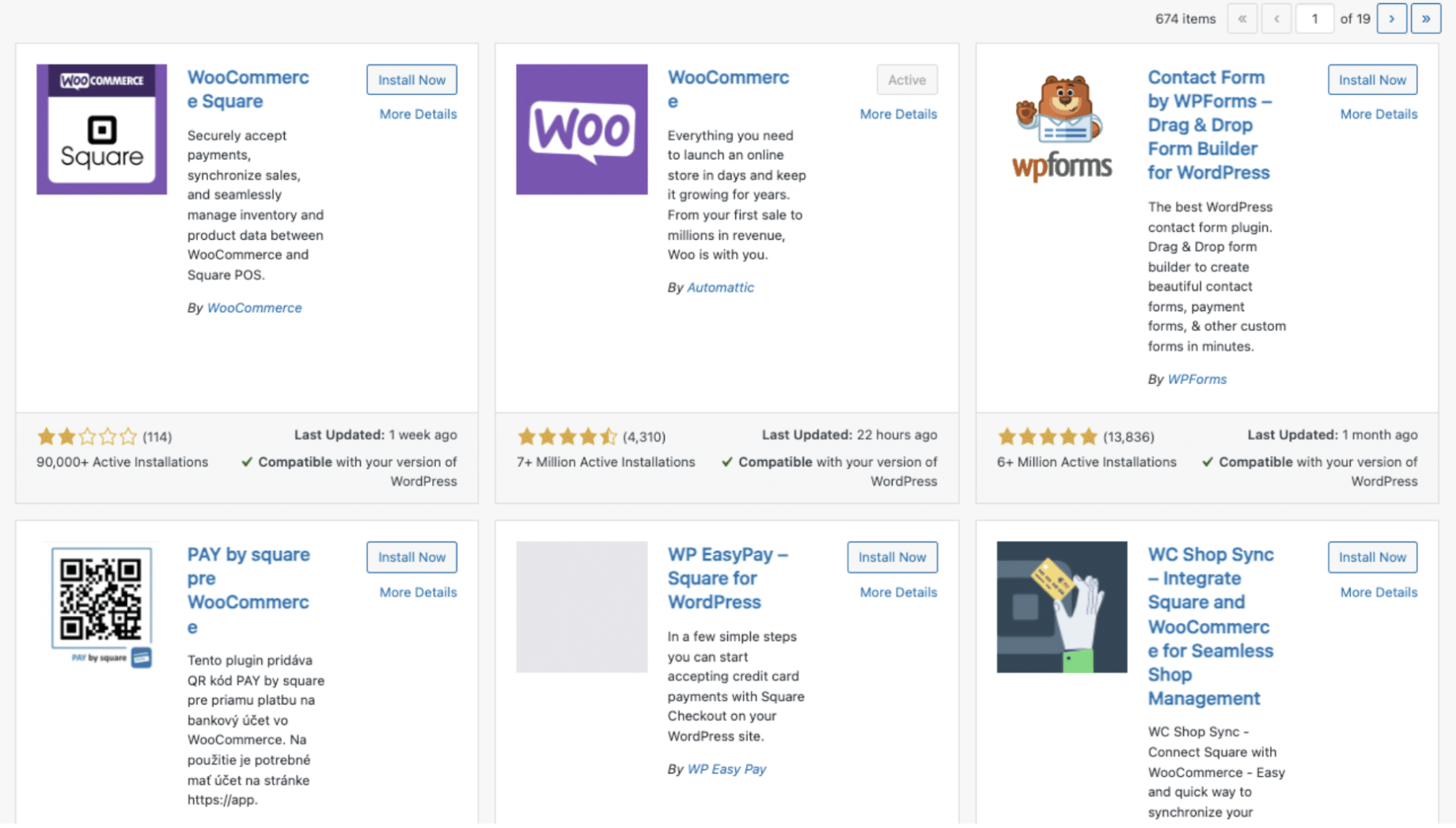

On WooCommerce specifically, the payment gateways are WordPress plugins you can download and add to your store. These gateways then integrate with your online store so customers can move seamlessly between your product listings and the checkout.

Alternatives like Shopify offer both built-in and integrated payment methods. However, WooCommerce has no native tools as it’s a WordPress website plugin. You must set up and manage your payment system from scratch. This adds more complexity compared to other ecommerce platforms, but ultimately gives you more freedom and control.

What Payment Gateways Does WooCommerce Support?

WooCommerce’s flexibility and range of plugins allow it to support many popular payment gateways. Here are the main types:

- Hosted: Redirects the customer to a third party to authorize the purchase.

- Self-hosted: Handles the entire process from your WooCommerce site.

- API: Integrates directly into your website via an interface.

- Local bank integration: Directly connects customers with a local bank.

- Mobile payment gateways: Manages card authorization for people paying on a device.

If you’re new to website development, it’s best to start with hosted and mobile payment gateways. They require the least setup and management. The tradeoff is that you have to direct customers off-site to make payments.

Most popular providers offer multiple WooCommerce-supported payment gateways. For instance, it’s common for a plugin to have a hosted and an API version.

What Do WooCommerce Payment Gateways Cost?

The cost structure depends on your choice of gateway:

- Transaction fees typically start at 2.9% + $0.30 for domestic cards. U.S.‑based Stripe, PayPal, WooPayments, and Square follow this standard.

- International transactions are higher, often +1% on top of the base rate.

- Monthly fees are optional—most gateways are pay‑as‑you‑go, but some include a service, which typically starts at $25/month.

- Setup fees depend on the provider or third‑party plugins—some may charge $49–$79, particularly for premium add‑ons.

Ads for “free” gateways typically mean no monthly or setup fees, but per‑transaction charges still apply across the board.

What to Look for in a WooCommerce Payment Gateway

Choosing the right payment solution affects more than just transactions—it impacts customer trust, conversion rates, and your own workload. Here’s how to evaluate WooCommerce payment gateways for your store:

Pricing Model: Transaction-Based or Subscription?

- Pay-as-you-go gateways (like Stripe or PayPal) charge per transaction, which works well for small or growing stores.

- Subscription-based gateways may charge monthly, in exchange for lower per-transaction fees—ideal for high-volume stores.

Tip: Look for transparent pricing without hidden setup or international fees.

Global Reach and Currency Support

- Some WooCommerce payment gateways only work in specific countries or regions.

- Make sure the gateway supports multi-currency payments and offers localized checkout for your audience.

- If you sell internationally, prioritize gateways with global infrastructure and low foreign exchange fees.

Payment Method Compatibility

- Your gateway should support major credit cards, digital wallets (Apple Pay, Google Pay), and emerging methods like Buy Now, Pay Later.

- Match your methods to your customer base—e.g., Gen Z prefers digital wallets, while older customers may still use credit or bank transfers.

Platform Compatibility and Ease of Use

- Hosted gateways are easier to set up, but they redirect users to an external checkout page.

- Self-hosted or API-driven gateways keep customers on-site and offer more control, but require technical setup.

Tip: When choosing between hosted and integrated gateways, evaluate your team’s expertise and appetite for ongoing management.

Security and Compliance

- All gateways must support SSL encryption, PCI DSS compliance, and ideally, built-in fraud detection tools.

- If you handle sensitive data directly, you’ll need to ensure GDPR and data privacy compliance yourself, especially with self-hosted solutions.

Hosted payment gateways typically bundle security protections so you can stay compliant with minimal manual work.

The Top WooCommerce Payment Gateways

The best payment gateway for WooCommerce for you depends on your specific business context. However, there are some standout options — the following provide all the essential features while ensuring a seamless service.

- WooCommerce payments: As this plugin was designed by WooCommerce, it integrates smoothly with its other features. You can handle your gateways from the main dashboard rather than the plugin tab.

- PayPal: Still the number one payment software, PayPal offers both a hosted payment and an API gateway. It mostly charges per transaction, but a few versions also have a monthly subscription.

- Stripe: This plugin lets you keep customers on your website to complete the transaction. Compared with alternatives, it’s also more developer-focused, meaning you can adapt the tool more easily to your exact needs.

- Square: If you own a physical store, Square is a good option for you. The platform offers a range of software features and equipment so you can build a cohesive system.

- Authorize.Net: One of the most robust WooCommerce payment gateways, this plugin lets you offer a variety of methods and detect fraud.

For a more detailed analysis, check out our WooCommerce payment gateways comparison.

Setting up WooCommerce Payment Gateways

Once you’ve chosen a platform, here are the typical steps to set up WooCommerce payment gateways.

Step 1. Install Your Chosen WooCommerce Plugin

Find the payment gateway you want from the WordPress plugin marketplace. Click ‘install now’ and then ‘activate’ to add it to your dashboard.

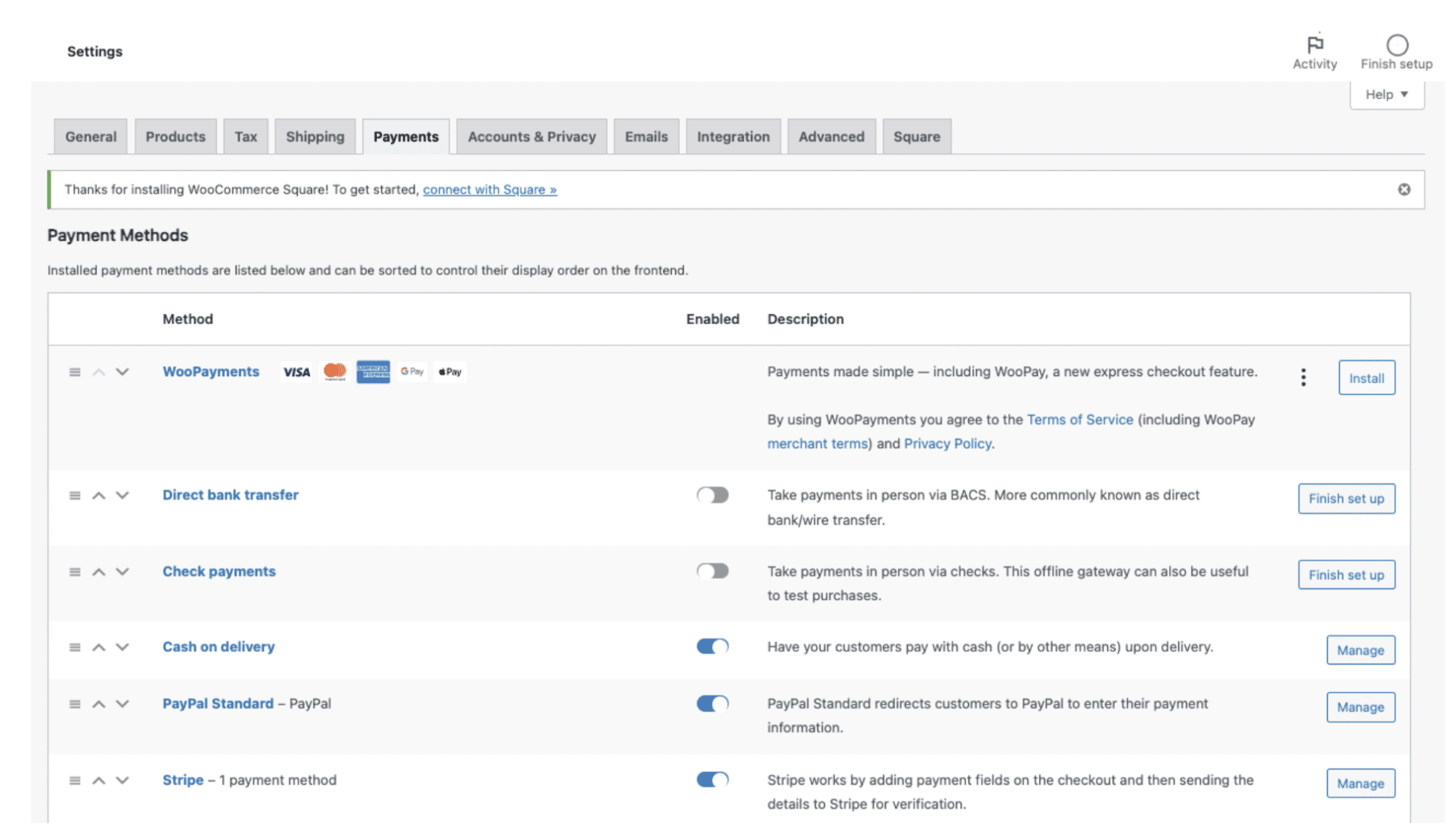

Step 2. Connect the Plugin

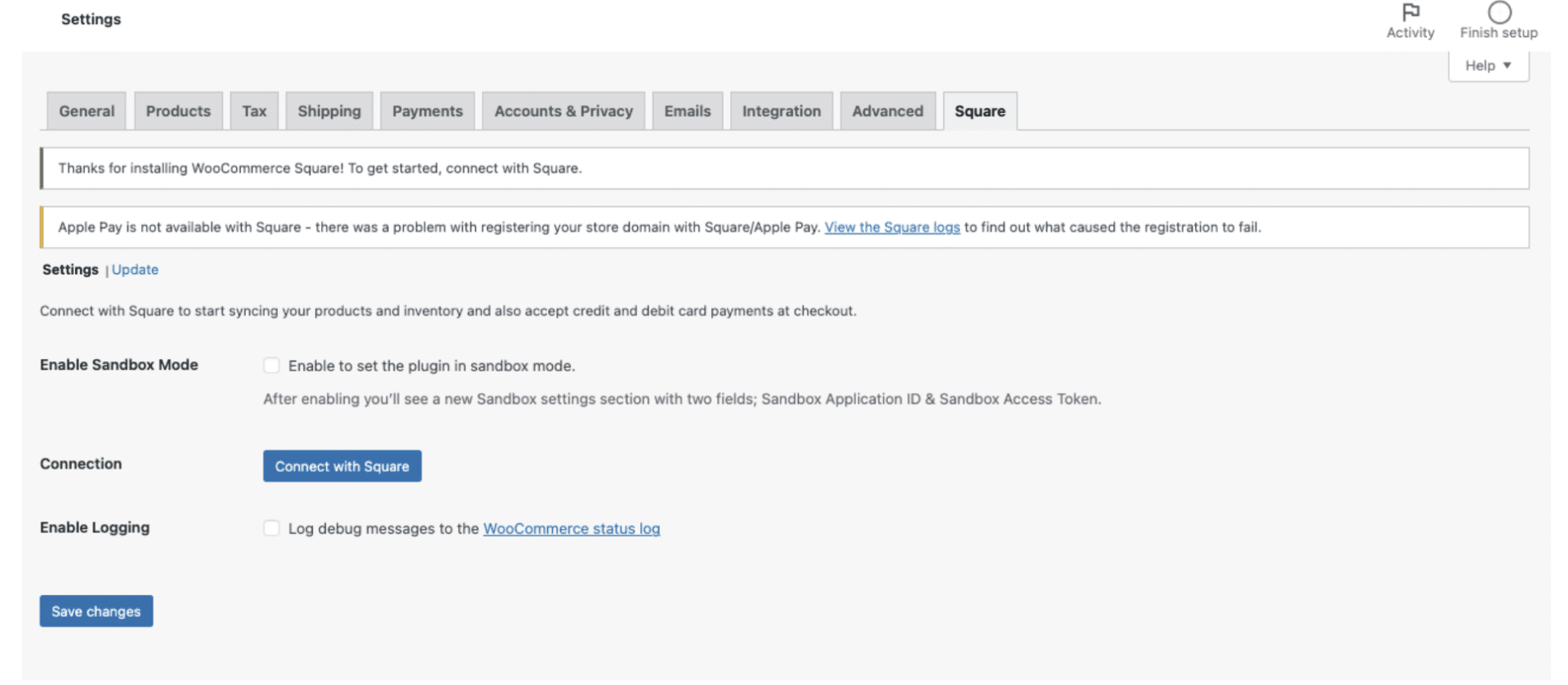

Once installed, the payment gateway will appear on your list of WordPress plugins. You also get a notification.

Click on the notification, and WordPress will redirect you to WooCommerce settings. Then click ‘connect’ to link your store and payment gateway accounts. If you haven’t already signed up for the plugin, it’ll prompt you to do so.

WordPress will ask for access to the plugin and permission to modify orders. Click ‘allow’ and you’ll get redirected back to WooCommerce.

Step 3. Configure Your Plugin Sync

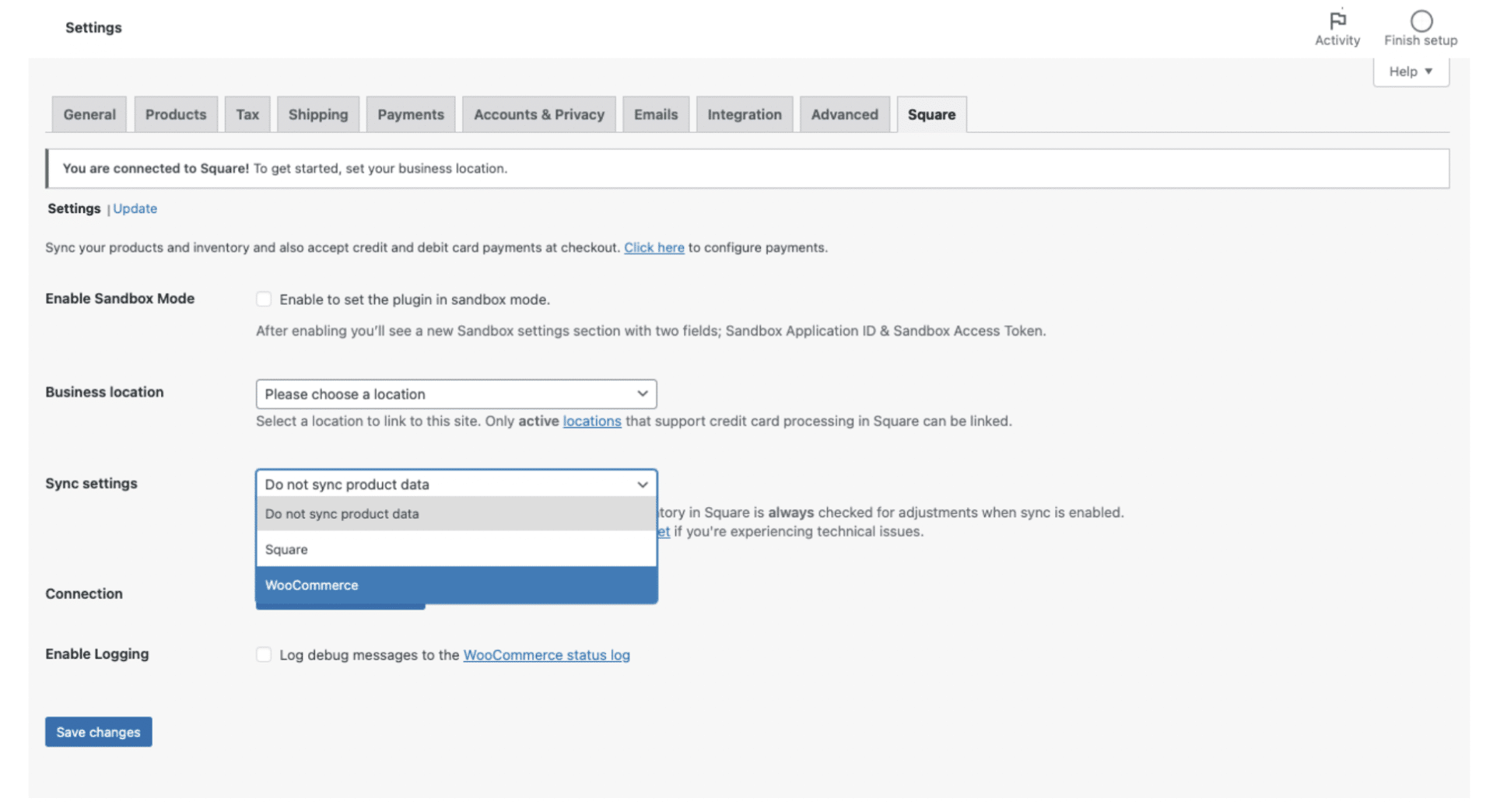

Turn on sandbox mode while you configure settings. You can set up and catch issues before you process real-life transactions.

Then choose how you want to sync your store data. You can select whether to update WooCommerce or the plugin from the drop-down menu.

You can then decide whether to push data to your payment gateway and how often to sync. That means WooCommerce and the plugin can update each other about orders and inventory changes.

Step 4. Customize Your Plugin Settings

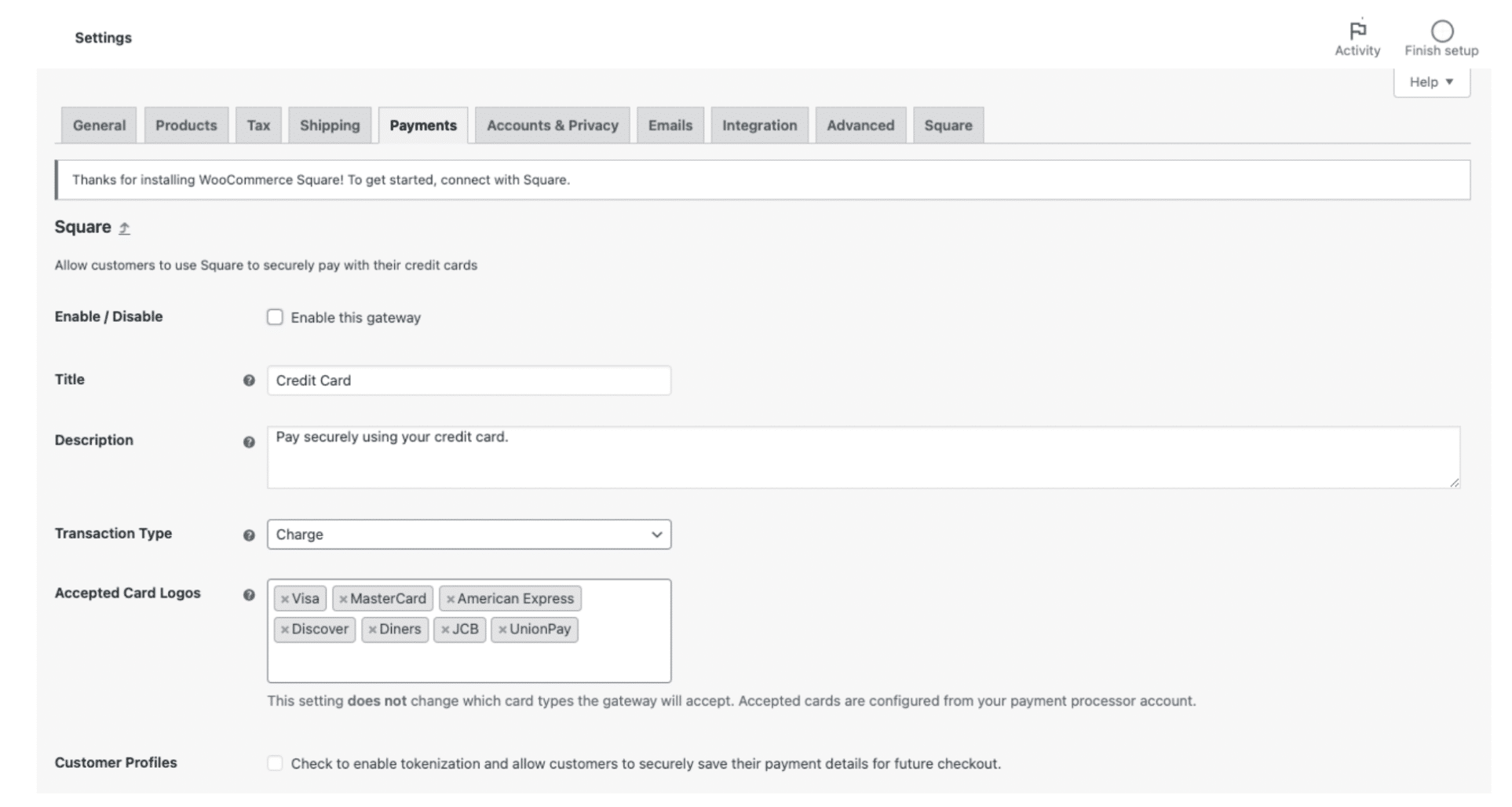

Go to the payment settings in your WooCommerce dashboard. Scroll to the payment gateway and click ‘manage’.

You can configure settings like:

- Field names

- Text and formatting

- Accepted card types

- Gift cards

- Automated messaging

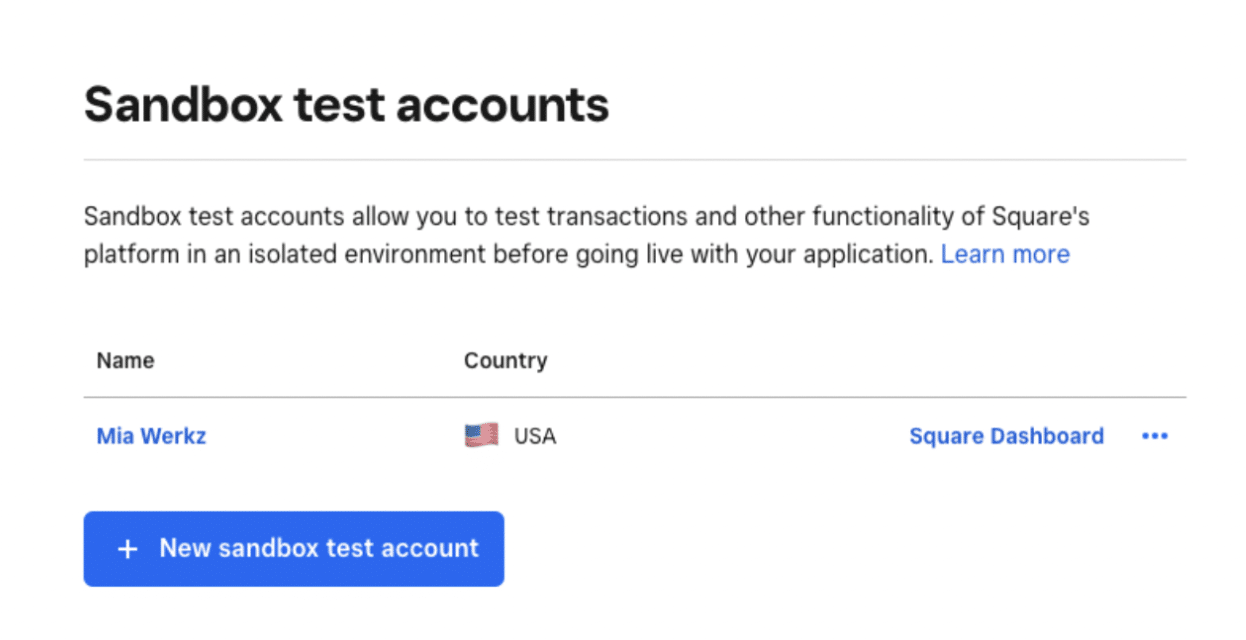

Step 5. Test the Plugin

Payment gateways often offer a sandbox environment where you can explore the features and test transactions. There’s no risk of any changes to your store.

You have to leave WooCommerce and sign into the plugin to perform these checks. Afterward, the exact steps depend on the specific payment gateway you’re using.

Step 6. Go Live

When you’re ready to accept purchases, first turn off sandbox mode. Then go to the payments tab in your WooCommerce dashboard and enable the plugin.

Managing WooCommerce Payment Gateways

Setting up your payment gateway is just the first step. To keep transactions running smoothly and avoid costly issues, ongoing management is key:

- Monitor performance regularly—especially in the first few weeks—to confirm everything is syncing and reporting correctly.

- Optimize your site speed to avoid checkout drop-offs caused by slow load times.

- Train your team on how to manage the plugin and troubleshoot common issues, so someone is always equipped to step in.

- Keep plugins updated to prevent security vulnerabilities, bugs, and compatibility issues with WooCommerce or WordPress.

- Test transactions periodically to ensure the checkout experience remains seamless across all payment methods.

- Stay compliant with data privacy regulations like GDPR and PCI DSS, especially if you’re managing sensitive payment data directly.

Handling Multiple WooCommerce Payment Gateways

Offering multiple payment gateways can increase conversions by giving customers more ways to pay. But managing too many can clutter the checkout experience and complicate your backend.

Here’s how to support multiple gateways without sacrificing performance or visibility:

Track Purchases by Gateway

WooCommerce’s centralized dashboard helps you manage and monitor payment activity from one place. In the Orders tab, filter by payment gateway to quickly check for issues like failed payments or delays. Use built-in statuses to spot problems early and streamline resolution.

Read our article on WooCommerce automation tools and plugins for more ideas on streamlining your store management.

Use WooCommerce Subscriptions

Recurring payments can simplify gateway management and reduce plugin juggling. With WooCommerce Subscriptions, you can:

- Automate billing across 25+ gateways.

- Manage everything from a single dashboard.

- Improve customer retention through auto-renewals.

Set Up Conditional Payment Logic

Avoid checkout overload by displaying only the most relevant payment options for each customer. The WooCommerce Conditional Payment Gateways plugin lets you control visibility based on:

- Location or currency.

- Cart total.

- Customer IP, language, and more.

This ensures customers see the most convenient options without confusion.

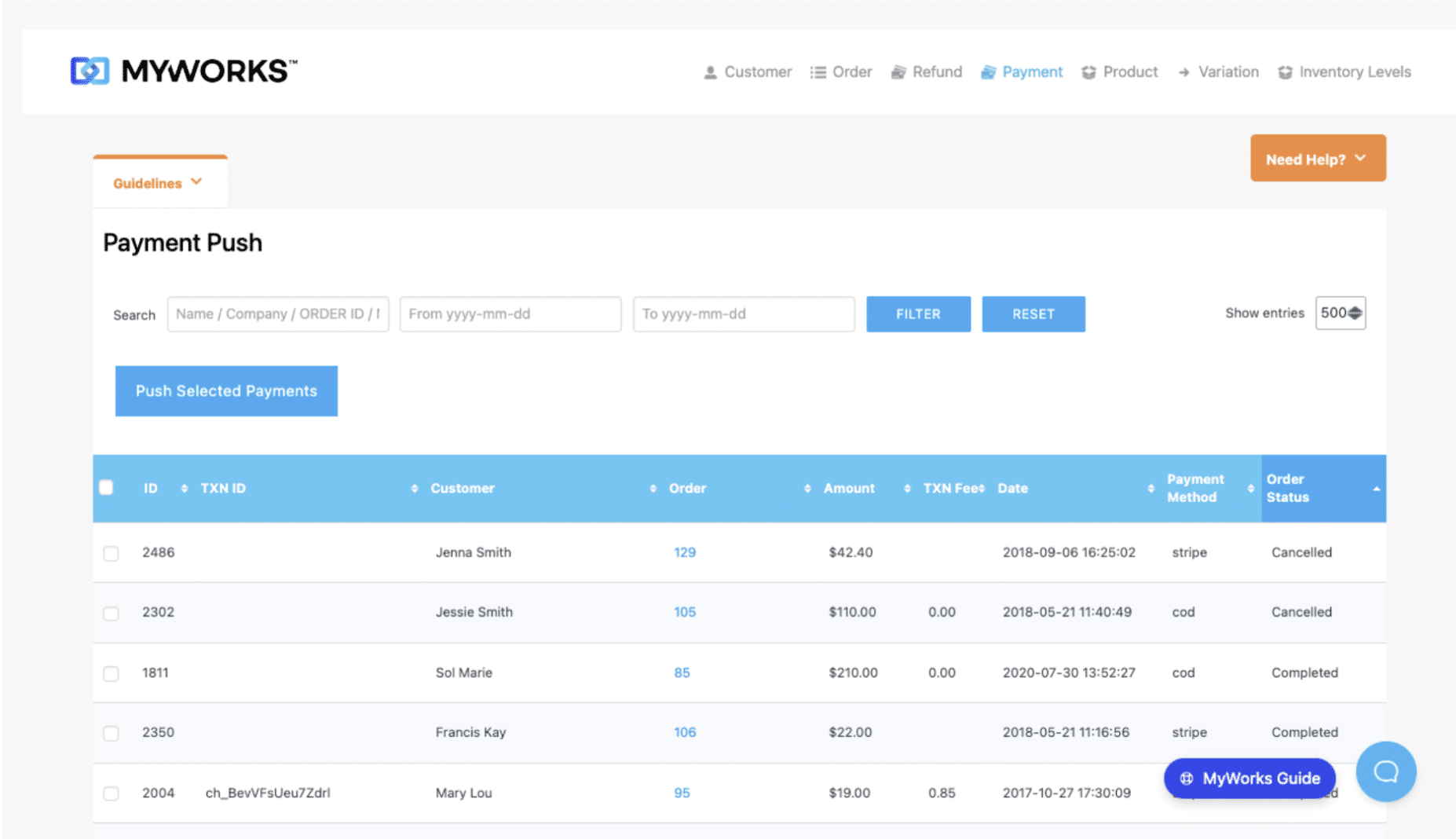

Sync Accounting With MyWorks

Manually reconciling sales from multiple gateways? You’re risking errors and wasting time. With MyWorks, you can:

- Automatically sync sales and payment data into QuickBooks or Xero.

- Customize field mapping per gateway.

- Ensure consistent, accurate reporting across every transaction.

Ensure Every Cart Makes it Through Checkout

Choosing the right WooCommerce payment gateways isn’t just about convenience—it directly impacts your ability to convert, deliver a smooth checkout, and keep your finances in order.

Offering multiple payment methods helps you meet every customer’s preference, but it doesn’t have to complicate your accounting. With a powerful sync like MyWorks, you can automate sales tracking across gateways, eliminate manual entry, and ensure error-free reconciliation in QuickBooks or Xero.

| Keep your WooCommerce store organized with MyWorks

MyWorks syncs every sale, payment, and field—so you stay organized, accurate, and ready to scale. |