Webgility is one of the few popular ecommerce integrations for Shopify stores that use QuickBooks Online or Desktop. However, its high costs and data syncing issues often push users to seek cost-effective and more reliable alternatives.

In this article, we’ll discuss the top five Webgility alternatives for Shopify accounting and bookkeeping. We’ll focus on their features, pricing, and drawbacks so you have all the information you need to make an informed decision.

What is Webgility?

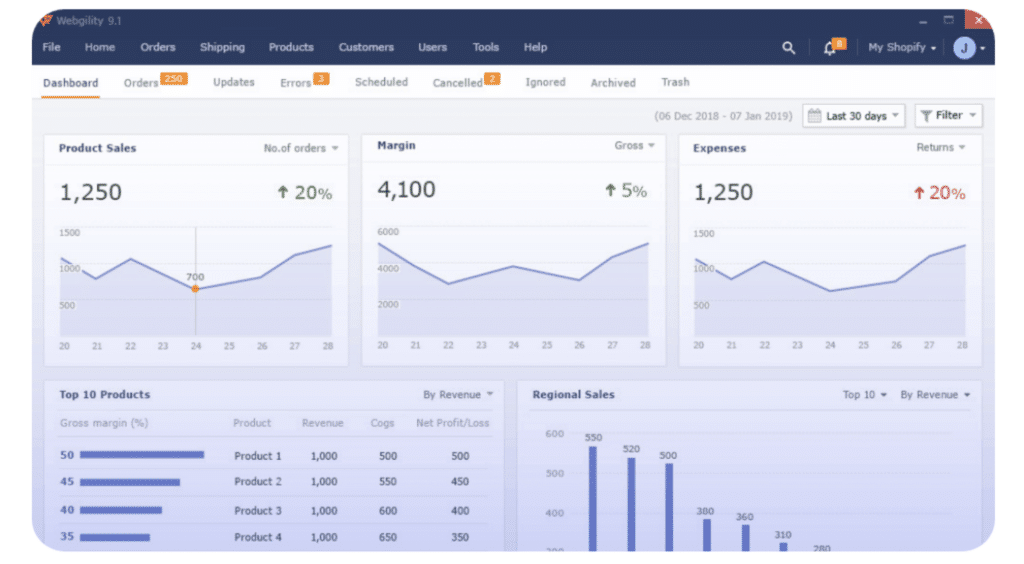

Webgility is ecommerce automation software that connects QuickBooks Online or Desktop to online store platforms like Shopify, WooCommerce, and Magento, allowing automatic data exchange between them.

For example, any sales made in Shopify can be reflected in your QuickBooks records. Integrating your platforms speeds up bookkeeping, inventory management, and accounting tasks for your ecommerce store.

Why Look For a Webgility Alternative?

Despite these features, Webgility users often look for an alternative for the following reasons:

1. Steep Learning Curve

Webgility can be complex and overwhelming initially, especially if you lack in-depth technical knowledge. While they offer onboarding support, the initial time and effort required to learn how the tool works delay its time-to-value—that is, how quickly you can enjoy its benefits.

This customer said it best. “It can be difficult to know if you have all the correct settings in place. I have often found myself struggling with something or doing something manually that the app could have done for me had I put the correct settings in place. All of this can be managed with one of their techs, but you need to know what questions to ask. It can take some time to get it all right.”

2. High Costs

Webgility is significantly more expensive than other ecommerce integration tools offering similar features. For example, its cheapest plan costs $49 per month, compared to MyWorks, which charges $19 monthly. This makes Webgility cost-inhibitive for growing ecommerce businesses with limited financial resources or tighter budgets.

And some customers, like this one, even feel they’re paying a high price for features they don’t need. “The price seems a bit high for what my needs are. Webgility offers more than I need in my line of business, but I still pay the price for all the additional perks it has. For smaller companies such as mine, the cost is a bit high.”

3. Syncing Issues

Some users have reported data syncing issues, affecting accounting data accuracy. For example, this customer had to update fields manually because Webgility wasn’t pulling in the correct information. Others have reported issues with inventory not syncing or multiple currencies not being reported correctly.

“Every single week, we had to raise or log a case since all transactions did not pull through, which meant we could not trust the automation. All fees went into our system with VAT. Thus, we had to manually update each record or do a mass calculation and entry into Quickbooks.”

The Best Webgility Alternatives For Shopify Websites

Now that you know why people look for a Webgility alternative, let’s look at the top five ecommerce automation software you can use instead for your Shopify store.

| Customer Ratings | Top Features | Pricing | |

| MyWorks | G2 Rating: 4.8/5 |

|

From $19 per month |

| Zapier | G2 Rating: 4.5/5 |

|

From $19.99 per month |

| Bold | Shopify Store Rating: 3.6/5 |

|

From $19.99 per month |

| Skyvia | G2 Rating: 4.8/5 |

|

From $99 per month |

| Shopify Connector by QuickBooks | Shopify Store Rating: 2.0/5 |

|

From $30 per month |

1. MyWorks: Two-Way Sync for Shopify and QuickBooks

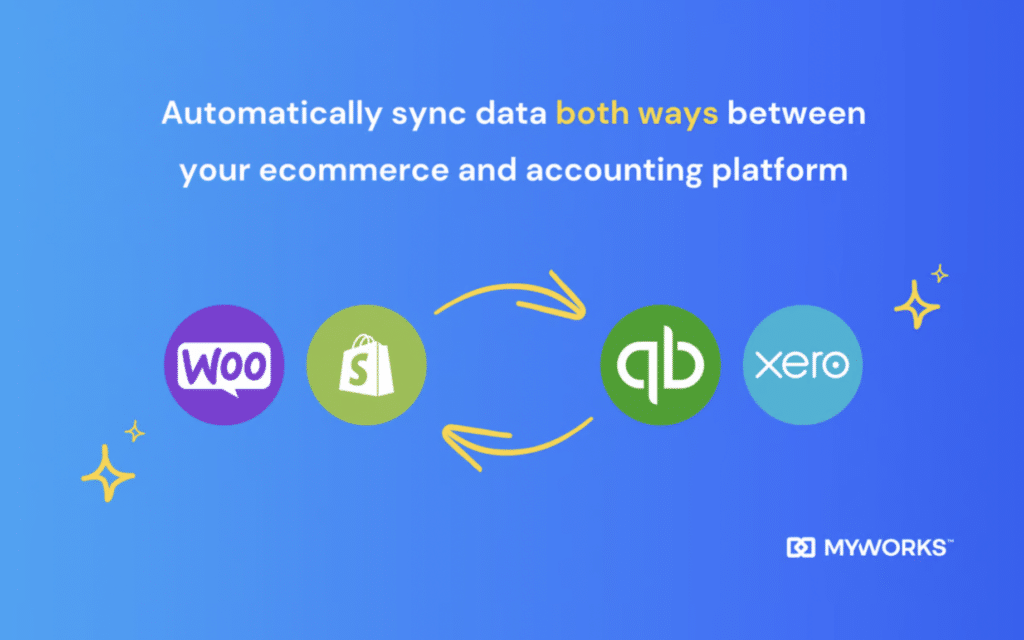

MyWorks is an ecommerce integration software that automatically syncs your accounting data between Shopify and QuickBooks, both ways.

For example, when a new customer is created in Shopify (after placing an order), that customer’s data (name, email, address) is synced to QuickBooks.

MyWorks is fully managed within your Shopify backend, eliminating the need for third-party tools that can compromise your data accuracy. In addition, it offers advanced features like custom field mapping and customization filters, which Webgility doesn’t offer.

Top Features

- Native Shopify integration: With MyWorks, you can manage your e-commerce accounting sync right from the backend of your Shopify store. There are no other platforms to log in to or manage.

- Flexible sync options: choose what data to sync, such as sales, customers, payments, fees, inventory, and refunds. You can also set up custom rules and filters for the sync process.

- Custom field mapping: MyWorks lets you customize how data flows between Shopify and QuickBooks by mapping fields based on your business requirements. This gives you complete control over your accounting setup and workflow.

- Xero integration: unlike Webgility, which only syncs with QuickBooks, MyWorks also lets you integrate your Shopify store with Xero accounting software.

- Reliable customer support: MyWorks is known for its responsive 24/7 customer support, offering on-time assistance as and when needed. Our team is available via email, telephone, and live chat. We also provide self-help resources so you can resolve issues and find answers independently.

Pricing

MyWorks has a free plan that lets you sync up to 20 orders monthly. If your needs exceed this, you’ll need to upgrade to one of our paid plans. We also offer a 14-day free trial for QuickBooks Desktop sync.

- Rise: $19 per month

- Grow: $45 per month

- Scale: $79 per month

- Soar: $99 per month

Check out the full pricing breakdown to see what each plan offers.

Related: Webgility vs. MyWorks: Which E-commerce Integration Software Should You Choose?

2. Zapier: No-Code Integration Software

Zapier lets you build custom integrations for Shopify and QuickBooks. For example, you can create an automation (Zap) to create new QuickBooks entries for Shopify customers. You can also build a Zap that creates new sales receipts in QuickBooks Online for Shopify paid orders.

Zapier’s major downside is that it is not software built specifically for ecommerce accounting automation. So, it’s missing advanced features, such as custom workflows, inventory level syncing, tax support, and multi-currency support. In addition, you’ll need to set up and manage these workflows yourself, which can be complicated and time-consuming as your business scales.

In summary, Zapier might be an option if you want to set up some basic e-commerce accounting automation. But if you plan to scale your online store, you’re better off with a specialized integration solution that evolves to meet your changing business needs.

Top Features

- Zapier offers ultimate flexibility to build automation and workflows suited to unique business needs. You can set up custom triggers based on order amount, shipping location, etc.

- You can connect your Shopify store to other Zapier apps, like CRM software, to extend its functionalities.

- It is easy to use and doesn’t require advanced technical or coding skills.

Pricing

Zapier uses scaled pricing. This means the more workflows you set up, the higher you pay. It also has a free plan (but Shopify and QuickBooks aren’t available for free users).

- Professional: From $19.99 per month (billed annually)

- Team: From $69.99 per month (billed annually)

- Enterprise: Contact sales for a quote

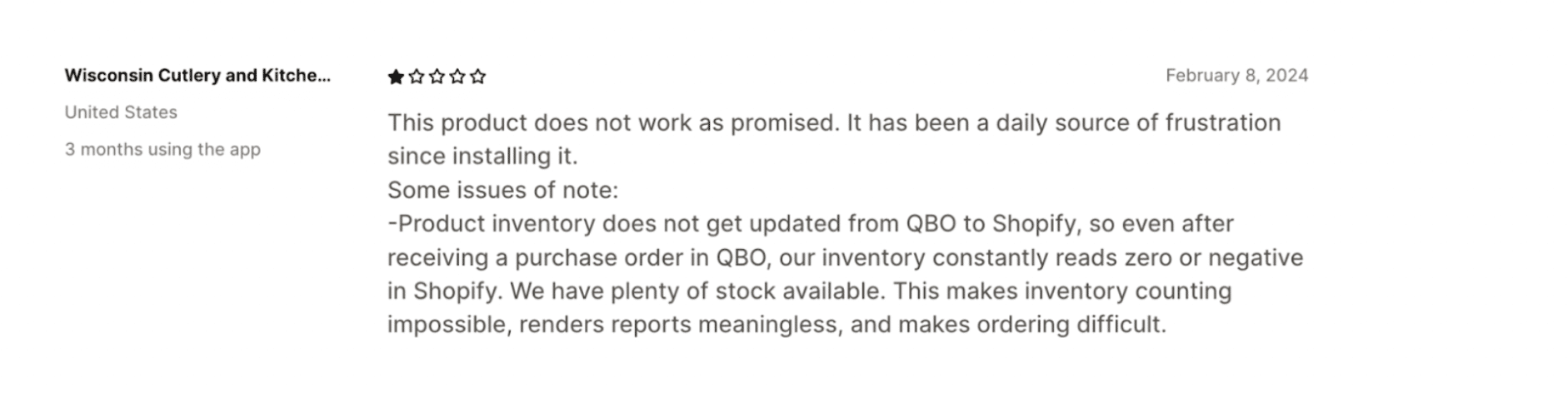

3. QuickBooks Sync by BOLD: In-App Shopify-QuickBooks Integration

Shopify App Store Rating: 3.3/5

The BOLD QuickBooks Sync allows you to automatically import orders and refunds from Shopify into your accounting or bookkeeping software. At the same time, you can sync product and inventory information directly from QuickBooks to Shopify. You can export your ecommerce accounting data anytime to third-party apps, such as custom dashboards.

However, multiple customer reviews suggest that Bold’s ecommerce integration software is buggy, leading to data syncing issues. For example, this user said that the store’s product inventory wasn’t updated from QuickBooks Online to Shopify, making reporting difficult. Other customers also complain about poor data mapping for price and cost fields and incomplete syncs.

Top Features

- QuickBooks Sync works directly in your Shopify admin backend.

- It provides access to a dedicated Quickbooks support team and extensive help center documentation.

- On-demand data exports.

Pricing

QuickBooks Sync has three pricing plans. It has no free plans but offers a 14-day free trial across all of its paid plans.

- Starter: $19.99 per month

- Growth: $39.99 per month

- Enterprise: $59.99 per month

4. Skyvia: No-Code Service for Shopify Integration

Skyvia is an iPaaS tool (Integration Platform as a Service) that lets you build custom integrations for accounting and ecommerce software. In this case, you can use it to automatically sync data between your Shopify store and QuickBooks Online and Desktop. Once done, you can use this integration to:

- Create QuickBooks Online invoices from Shopify Orders

- Automatically generate QuickBooks Online sales receipts from Shopify Orders

- Import and export data as CSV files

Like Zapier, Skyvia isn’t a specialized ecommerce integration software, meaning you’ll have to set up and manage your workflows manually. Things can easily get complicated as your online store grows. In addition, it’s very expensive compared to specialized solutions like MyWorks.

Top Features

- Skyvia has a robust integration library, allowing you to build custom workflows for your Shopify store.

- It offers custom field mapping and data handling.

- Skyvia provides ready-made integration templates for common use cases, making it quick to start syncing important data like orders, products, and customers.

Pricing

Skyvia offers different pricing packages for data integrations, automation, and connection. Here’s the breakdown of its data integration plans:

- Basic: $99 per month

- Standard: $199 per month

- Professional: $249 per month

- Enterprise: Custom pricing

Overall, if you want to build complex integrations for your ecommerce workflow across multiple apps and platforms, Skyvia’s high price point might make sense for your business. However, if you want a simple and reliable way to sync Shopify and QuickBooks, you’re better off with a cost-effective solution like MyWorks.

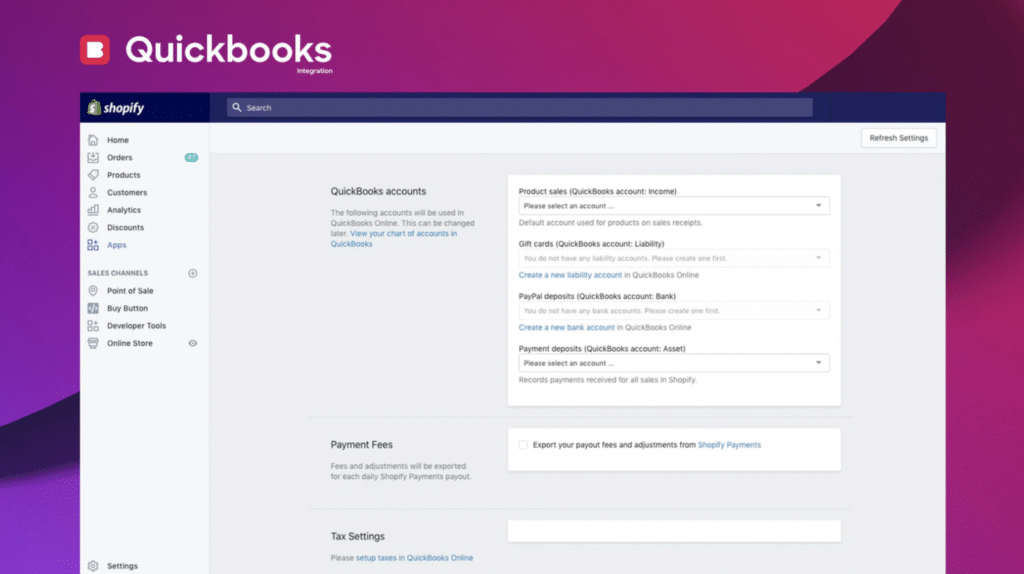

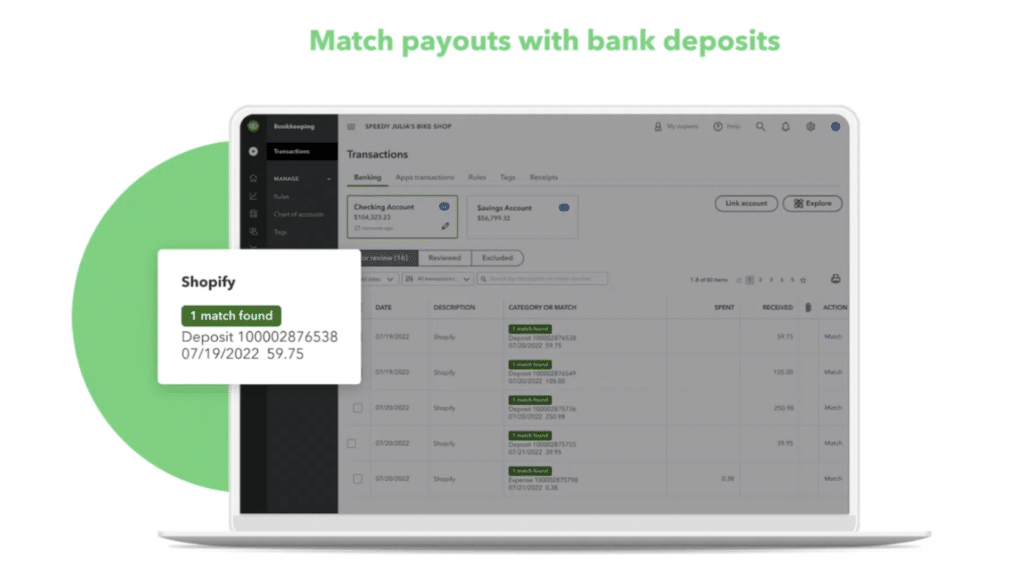

5. Shopify Connector by QuickBooks: Sync Payouts Between Shopify and QuickBooks

Shopify App Store Rating: 2.0/5

Shopify Connector by QuickBooks (previously OneSaaS) is an integration tool that connects Shopify with QuickBooks Online, allowing for seamless synchronization of accounting and bookkeeping data between the two platforms.

However, it’s a very simplistic sync solution. For example, it only brings over basic data like payment totals but doesn’t break down transaction fees, refunds, or taxes. In addition, it doesn’t sync inventory both ways, and product syncing can be buggy.

Here’s how one customer describes their experience with the tool.

“This app is messy, only occasionally brought in data and I was never able to implement it in any way close to useful. There is no support and none of the needed updates are being made.”

Top Features

- Shopify Connector syncs full and partial funds

- It offers hourly sync intervals to QuickBooks

- It is free for QuickBooks Online customers

Pricing

Shopify Connector is free for existing QuickBooks Online users. If you’re new to QuickBooks, pricing starts at $30 per month, with 30% off for the first 12 months.

Related: MyWorks vs. Shopify Connector: which one should you choose?

What to Consider When Choosing a Webgility Alternative

Here are the top four things to consider when choosing a Webgility alternative for your Shopify store.

1. Workflow Customization

Ensure that the ecommerce integration platform allows you to tailor workflows based on your needs. For example, you might want custom automation for certain order types, inventory processes, or customer segments. A platform with flexible rule-based workflows will give you the freedom to streamline your operations.

MyWorks excels, providing advanced sync support for every QuickBooks and Shopify category. This lets you fine-tune your sync settings to match your store’s setup.

2. Syncing Capabilities

Pay attention to how efficiently the integration syncs orders between your ecommerce store, accounting software, and other systems. Does it offer real-time syncing, or are there delays? Does it support important workflows in your business, like inventory syncing and currency support? This is particularly important for businesses with high transaction volumes where order information needs to be updated instantly.

With MyWorks, you can sync data between Shopify and QuickBooks in near real-time. You can transfer information between both apps every five minutes or hourly, depending on your preference.

3. Value for Money

Choose an ecommerce integration tool that offers the features you need at a reasonable price. Look for pricing tiers that scale and provide additional capabilities as your business grows.

For example, with MyWorks, you can start syncing data between Shopify and QuickBooks for free. We also have flexible paid plans, starting at only $19 monthly.

Which Ecommerce Integration Tool Wins?

MyWorks is the best Webgility alternative for Shopify stores. Unlike Webgility, MyWorks lives right in your Shopify backend, eliminating data risks and complications from third-party tools.

It also offers unmatched customization options, including multi-currency support and syncing partial and full refunds. The best part is that you get these features at less than half of Webgility’s costs.

Want to test things for yourself? Try our Shopify and QuickBooks sync for free.