You can’t run a WooCommerce site without at least one payment gateway. After all, that’s how you get paid!

The good news is that WooCommerce offers hundreds of plugins, which you can easily install from the WooCommerce marketplace.

It’s easy to get overwhelmed by all the options. However, the payment gateway you use is a very important business decision. Choose one without all the key components, and you could face operational challenges, dissatisfied customers, and lost revenue.

In this article, we compare the best WooCommerce payment gateways so you don’t have to. We’ve analyzed them based on their key features, pricing, and who they’re for. Read on to discover which are best for your store and which to consider in the future.

WooCommerce payment gateways compared

Here’s an overview of the main comparison points before we look at each option in more detail:

| Name | Fees | Locations | Currencies | Redirected offsite? | Key features |

| WooCommerce Payments | 2.9% + 0.3c per domestic US card transaction | 38 | 135 | No | Tap to pay, custom deposit, and BNPL |

| Stripe | 2.9% + 0.3c per domestic US card transaction | 45 | 135 + | No | UI building blocks, fraud detection, and autofill |

| Square | 2.9% + 0.3c per domestic US card transaction | 8 | 8 | No | System of record, gift cards, and delayed payments |

| Authorize.net | $25 per month plus 2.9% + 0.3 % transaction fee | Australia, Canada, New Zealand, and the US | 9 | No | Restricted card types, pre-orders, and saved checkout details |

| PayPal | 2.99% + 0.49c per domestic US card transaction | 202 | 25 | Both | Installments, checkout buttons, and country-specific payment methods. |

| Amazon Pay | 2.9% + 0.29c per domestic US card transaction | 18 | 80 | Yes | Voice commands, delivery notifications, and A to Z guarantee |

| Braintree | 1.99% + $.49 per domestic US transfer | 45 | 130+ | No | Payment routing, fraud detection, and 3D secure support |

| Skrill | 1% per domestic US transaction | 120 + | 40 + | Yes | Fraud protection, cryptocurrency |

| Alipay | $6.59 per month plus additional fees for international transfers | 150 + | 20+ | Yes | Exchange rates, QR codes, and paid setup service |

| Razorpay | 2% | India and Malaysia | 100 + | No | Affordability widget, reporting, and analytics, order settings |

New to ecommerce? You should know that most online stores have multiple WooCommerce payment gateways to cater to different customer preferences. The exact ones you should choose depend on your specific business context. To learn further, check how to set up a WooCommerce payment gateway.

For example: What’s in your budget? Where are you selling? Who’s your target market? Do you have the expertise to manage certain plugins?

Avoid getting more payment gateways than necessary. You don’t want to overwhelm shoppers with options and have them abandon their carts.

Keep these ideas in mind as we compare the top ten WooCommerce payment gateways below:

1. WooCommerce Payments

Designed especially for WooCommerce, this option integrates seamlessly with your site. That means you manage payments directly from the dashboard without opening third-party plugins or configuring settings. You may also know it as “WooPayments”.

Key features

- Tap to pay: Order a contactless card reader that syncs with your site inventory.

- Custom deposit schedule: WooCommerce lets you decide how often you transfer funds from your account to your bank. It can be daily, weekly, monthly, or on-demand.

- Buy Now Pay Later (BNPL): Customers can confirm the purchase but transfer the payment later. As 9% of global e-commerce is now BNPL, offering this service could boost your sales.

Pros

- Only a fully integrated solution with WooCommerce

- Easy to set up and manage

- Support for multiple currencies

Cons

- Limited to WooCommerce sites

- Less feature-rich than some alternatives

- Only available in certain countries

Best for:

If you’re starting WooCommerce, this payment gateway is a great option. There’s an easy setup process, and the software is intuitive. Plus, you can get used to the platform’s native settings and features before adding plugins.

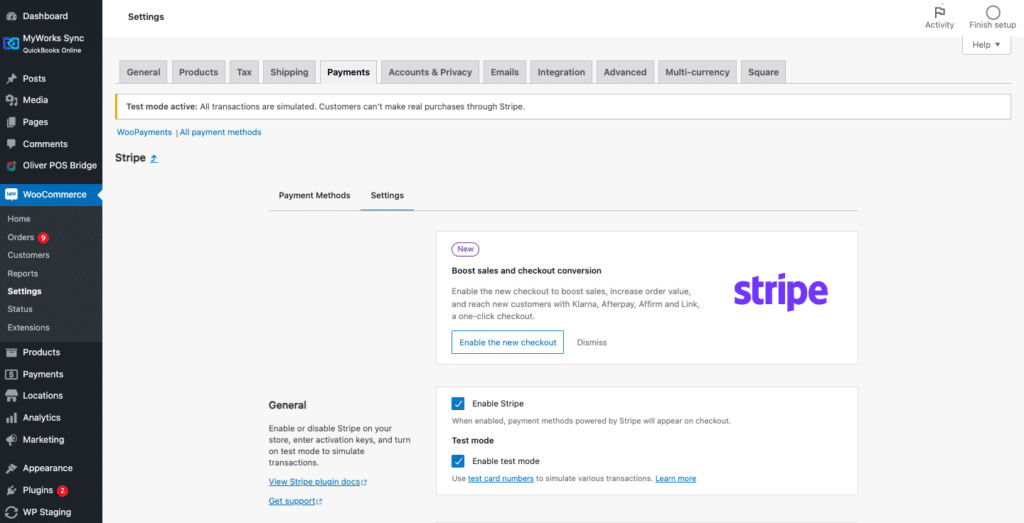

2. Stripe

Stripe is a developer-friendly platform known for its extensive API capabilities. If you have the tech expertise, you can embed the payment gateway into your WooCommerce site. That way, customers don’t have to leave the page, meaning they have a smoother checkout experience.

Key features

- Stripe elements: Site administrators can use pre-built forms to create and customize their checkout. These include BNPL messaging, one-click payment buttons, and address collection forms.

- Stripe Radar: Stripe scans transactions to verify their legitimacy or detect fraud. If there’s an issue, you’ll receive an alert.

- Autofill payments: Customers can choose whether to save their details using Link. If they pay using Stripe again, the payment fields are auto-populated.

Pros

- Highly configurable

- Advanced security features

- Support for multiple currencies

Cons

- Complex to set up

- No direct phone support

- High additional fees

Best for:

Global e-commerce businesses that require extensive customization. You can change fonts, colors, and logos to reflect your brand. With your unique look and over 135 currencies, you’ll find it easy to build international recognition.

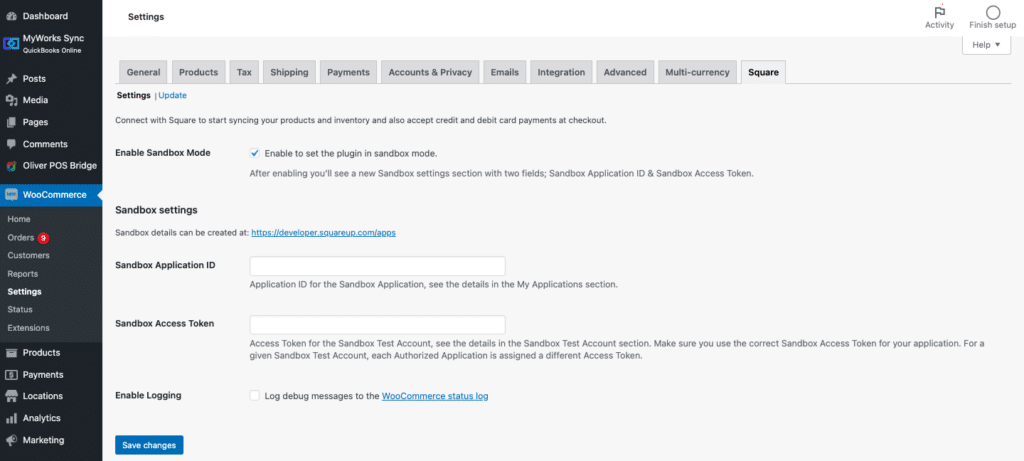

3. Square

Square provides end-to-end sales management. In addition to the payment gateway and processing features, it has a range of physical equipment, such as POS systems and card readers. These all integrate seamlessly so that you can maintain efficient operations and consistent sales records across all your stores.

Key features

- System of record: If you have a physical store and a WooCommerce site, you can push all the data to Square.

- Gift cards: It’s possible to enable gift cards as a checkout option and offer them to customers.

- Delayed payments: You can store payment details at checkout, but wait until you’ve shipped to initiate the transfer. That way, there’s zero risk of having a stockout and inconveniencing customers with a refund.

Pros

- Integrated support for online and offline sales

- Older versions are available to download

- Discounts at volume

Cons

- Limited international support

- Lots of additional fees

Best for:

Square is ideal if you own a small US store in the beauty or service industry. The comprehensive suite of features can help you manage your online and offline sales.

4. Authorize.net

As one of the most longstanding solutions, Authorize.Net has built a strong reputation. It’s most well-known for being a versatile and reliable option. The payment gateway offers an impressive range of payment options and security features and handles billions of transactions annually.

Key features

- Restricted card types: Authorize.Net can hide certain payment options if you prefer not to accept them.

- Pre-orders: With the Enterprise account, you can let shoppers order products before they’re available. Authorize.Net automatically initiates the payment when you get them in stock.

- Saved checkout details: Patrons can save their preferred payment methods and even give them nicknames. That means if they use multiple options, you can still maintain a smooth checkout experience.

Pros

- Supports a range of payment methods

- Highly reliable and secure

- A comprehensive range of features

Cons

- Limited international support

- Monthly subscription fees

- Complex to set up

Best for:

Authorize.net is best for established US businesses with high transaction rates. You can easily absorb the monthly subscription costs, and you’re most likely to benefit from offering a range of payment options. As you manage a lot of transfers, you no doubt have many customers with varying needs and preferences.

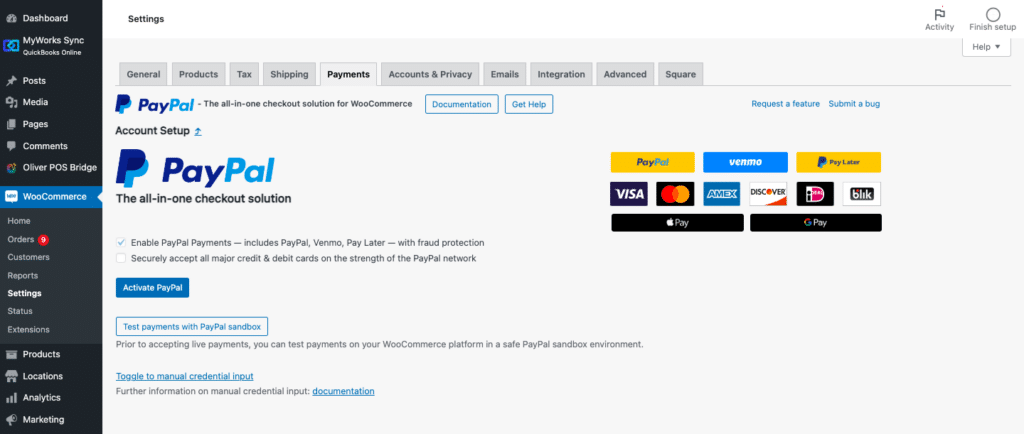

5. PayPal

Although many new payment gateways have emerged in recent years, PayPal has remained the most popular option. They currently have over 400 million active users worldwide. You can either embed PayPal on your checkout page or redirect users briefly to their site.

Key features

- Installments: Customers can arrange to pay over time with PayPal Pay Later, while you receive the money upfront, all at no extra cost.

- Checkout buttons: Add the PayPal button to your store’s checkout as a payment option.

- Country-specific payment methods: PayPal supports methods only available in certain locations. For example, you can offer Payment Upon Invoice for purchases in Germany.

Pros

- World-famous, reputable brand

- Easy to set up and use

- Discounts at volume

Cons

- Requires customers to have a PayPal account

- Holds funds for an extended period

- Some high international transaction fees

Best for:

Due to its popularity, most e-commerce businesses should offer PayPal. Offering this payment method in your store can be a powerful tool for establishing trust with customers.

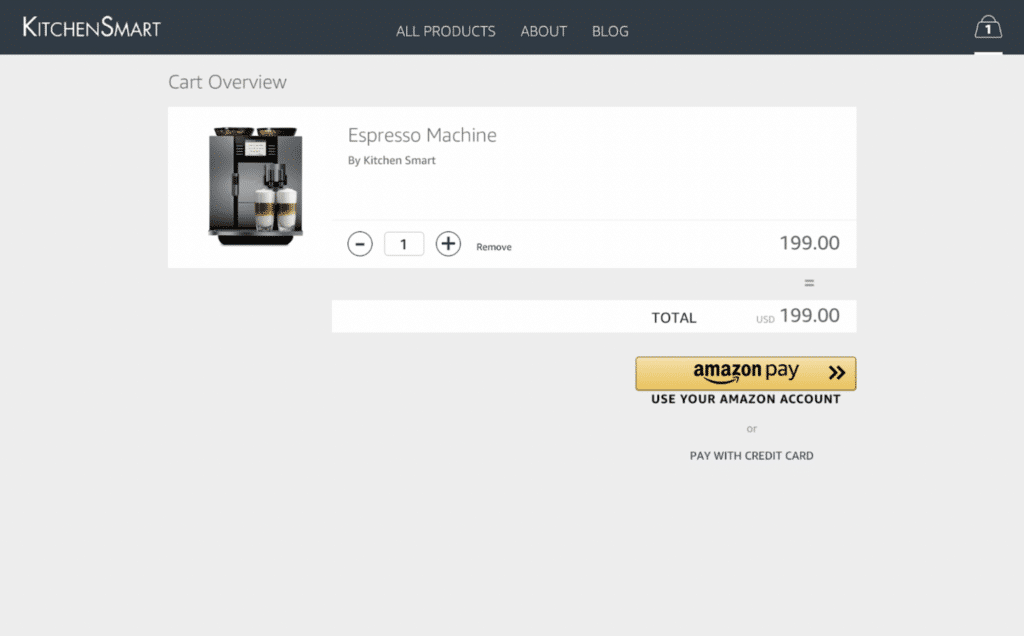

6. Amazon Pay

Amazon Pay is a payment gateway owned by, you guessed it, Amazon. If customers have an existing Amazon account, all they have to do is click the item and choose one of their saved payment methods. They can also benefit from many of the company’s other well-known features, such as Alexa and Prime.

Key features

- Voice commands: If customers have Alexa, they can ask her to order products directly from your store.

- Delivery notifications: Customers can receive updates about the delivery status of physical goods they’ve ordered through Amazon.

- A to Z Guarantee: Amazon covers the sale in case of a product or delivery issue. With this extra guarantee, new customers are more likely to take a risk on your store rather than looking elsewhere for an item.

Pros

- Well-known, international brand

- Integrations with Amazon’s other features

- Possible to save multiple payment and delivery options

Cons

- Requires customers to have an Amazon account

- Restrictions on certain industries

Best for:

If you’re beginning to expand abroad, you should add Amazon Pay to your payment gateways. This well-known brand can easily build trust with an international customer base, and Amazon Pay has extensive global coverage, so you won’t miss opportunities to sell in different countries.

7. Braintree

Although PayPal owns Braintree, it serves a different purpose. It has a robust API that allows you to customize and control the payment process more easily. However, you can still benefit from PayPal’s familiar branding by adding Pay Now and Connect buttons to your site.

Key features

- Payment routing: You can set up Braintree to send payments in specific currencies to their corresponding accounts.

- Fraud protection: Braintree has a range of tools designed to detect risks and reject suspicious transfers. The standout feature is the ability to set your own rules.

- 3D secure support: Customers can verify their purchase through mobile pop-ups and messages. If you only need extra security for certain scenarios, you can add rules that say who’s exempt.

Pros

- Competitive transaction fees

- Association with the reputable PayPal brand

- Highly customizable

Cons

- High fees for some payment methods

- It can be complex to set up

- Requires ongoing maintenance for API updates

Best for:

Growing businesses should consider Braintree. The platform has all the customization tools you need to build scalable payment processes. However, it still has the PayPal branding and international coverage to appeal to a global audience.

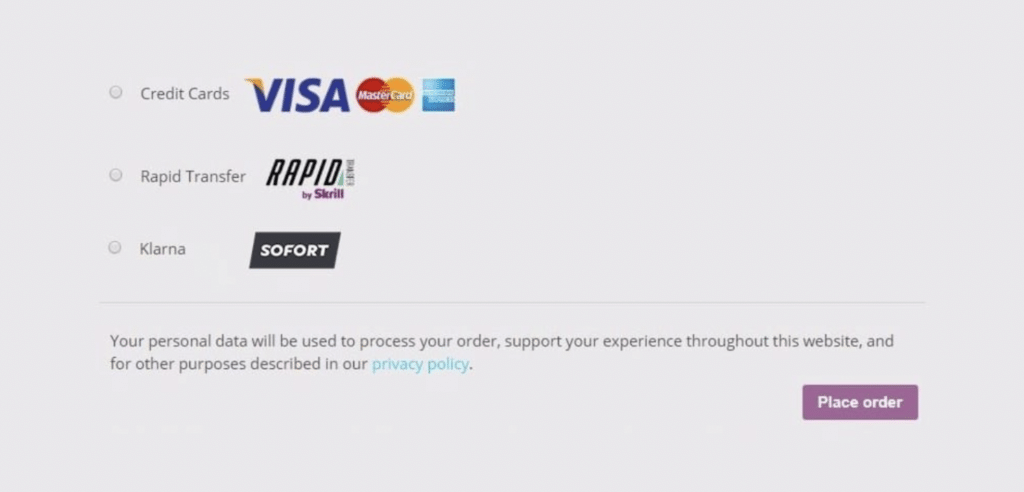

8. Skrill

While it’s less well-known than PayPal and Stripe, Skrill is a mainstay in the global payment solutions market. It’s been serving businesses since 1996. The payment gateway is a simple but low-cost option that covers all the essential features.

Key features

- Fraud protection: Skrill monitors your accounts for suspicious payments and activities.

- Cryptocurrency support: The Skrill digital wallet integrates with the service so customers can make payments using a range of cryptocurrencies.

Pros

- Available in over 120 countries

- Support for over 80 banks worldwide

- Competitive transaction fees

Cons

- Less recognized compared to some alternatives

- High conversion fees

- Restrictions on certain industries

Best for:

Skrill is a good option if you have tight profit margins and must keep transaction fees low. The competitive rates and free subscription make it easy to stay within budget. However, you won’t sacrifice quality or coverage for the lower costs.

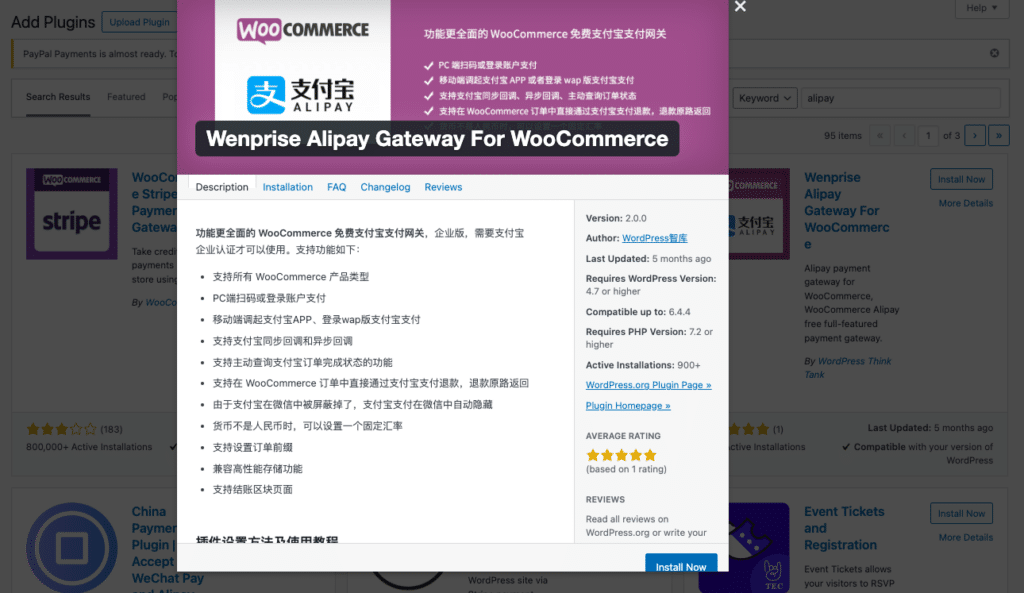

9. AliPay

Owned by the Alibaba Group, Alipay is one of the largest mobile payment platforms in the world. The company is predominantly based in China, but merchants can still use the payment gateway without a Chinese bank account.

Key features

- Exchange rates: You can set a fixed rate when you’re not charging in Chinese RMB. Customers can see this amount both before they confirm the purchase and afterward on the bill.

- QR Codes: If you have a physical store, you can generate QR codes to allow customers to pay for products.

- Paid setup service: For an extra fee, you can have Alipay install and configure your WooCommerce plugin.

Pros

- Number one payment gateway in China

- Available in most countries worldwide

- No fee for domestic Chinese transfers

Cons

- Instructions are only in Chinese

- Monthly subscription costs

- Some features are limited to China

Best for:

Due to its popularity in China, you should strongly consider Alipay if you’re targeting East Asia. The platform has over 650 million active users that you can appeal to.

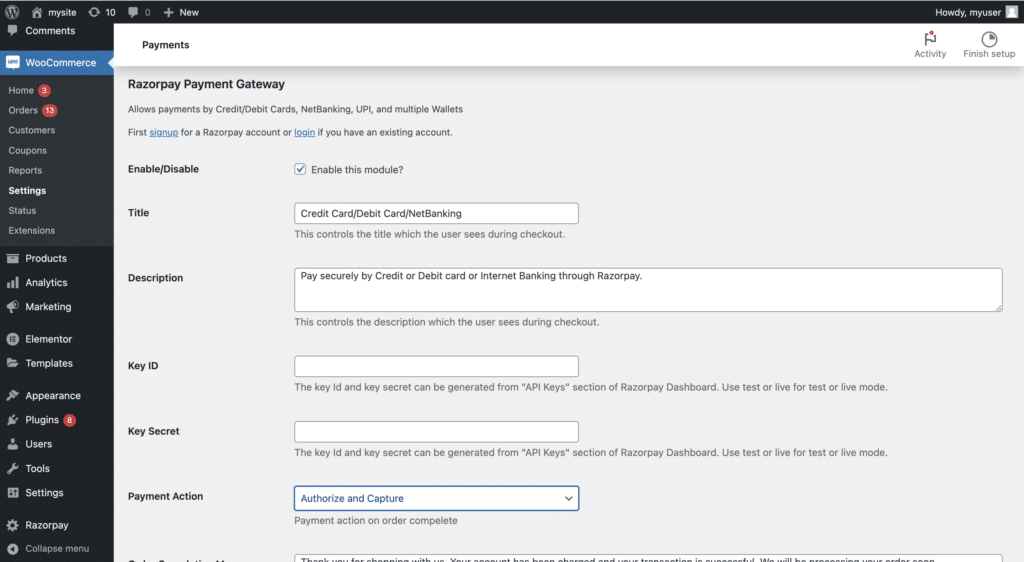

10. Razorpay

Razorpay is a popular Indian payment solution that also serves the Malaysian market. The platform is known among businesses for being comprehensive and secure.

Key features

- Affordability Widget: Customers can see a box with payment options and possible savings while browsing.

- Reporting and Analytics: Razorpay generates reports on payments, settlements, and refunds, giving you greater insight into your business performance.

- Order Settings: Merchants have extensive control over which customers can benefit from offers. You can set a limit or filter by payment method.

Pros

- User-friendly dashboard

- Flat 2% transaction fee

- Supports a range of popular payment methods

Cons

- Requires a business presence in India and Malaysia

- Some advanced features require technical expertise

Best for:

Like Alipay, Razorpay is a great investment if you’re a larger company that wants to establish a business presence in South Asia. You can cater to thousands of Indian and Malaysian customers and gain trust through association with the popular platform.

Keep customers happy without losing track of sales

Finding the right combination of WooCommerce payment gateways can help you attract and retain customers. It’s important to consider each option carefully to ensure you’ve got ones that suit your store.

At least you don’t have to worry about how to record all the sales. No matter the payment methods you choose, MyWorks lets you automatically share all WooCommerce sales data with your accounting software. All you have to do is choose how often you want to sync the platforms.

| Automate your store’s books.

With MyWorks, you can connect your ecommerce and accounting platforms, ensuring your sales data is always updated and accurate, in both WooCommerce and your accounting tool. |