Ecommerce accounting entries are the backbone of accurate financial reporting for online stores. Every sale includes multiple financial components: revenue, taxes, shipping, discounts, inventory changes, and processor fees—and each one needs to be recorded correctly to keep your books reliable.

Journal entries give structure to this complexity. They show exactly what happened in each transaction and ensure your debits and credits stay balanced.

In this guide, we’ll break down how ecommerce journal entries work, why they matter, and how to record them using clear, practical examples. We’ll also look at how ecommerce accounting automation tools, such as MyWorks, help remove manual work and reduce the risk of journal entry errors.

What Is a Journal Entry in Ecommerce Accounting?

A journal entry is a record of a financial transaction that lists the accounts affected and the debit and credit amounts applied to each one.

In ecommerce, a single order often triggers several journal entry components, including revenue, shipping income, cost of goods sold (COGS), inventory adjustments, processor fees, and sales taxes.

A complete journal entry for ecommerce typically includes:

- The transaction date.

- Order number or reference.

- A short description of the transaction.

- Accounts impacted (Assets, Liabilities, Revenue, Expenses, Equity).

- Debit amounts.

- Credit amounts.

Ecommerce accounting almost always uses double-entry accounting, meaning every debit must have a matching credit to keep the books balanced.

Why Journal Entries are Crucial for Ecommerce Businesses

Journal entries form the foundation of accurate financial statements, like your profit and loss (P&L), balance sheet, and cash flow statement. But ecommerce introduces complexities that traditional retail doesn’t encounter.

Common ecommerce journal entry challenges include:

- Multiple sales channels (Shopify, WooCommerce, Amazon, POS, subscriptions).

- Multiple payment processors (Shopify Payments, PayPal, Klarna, Stripe).

- Varied sales tax requirements across regions.

- Timing differences (e.g., Shopify payouts vs. authorization date).

- Shipping income vs. shipping expense differences.

- Payment processor fees deducted before deposits.

- Gift cards (liability, not revenue).

- Discounts applied at checkout.

- Bundles and multi-SKU orders.

When these elements aren’t recorded correctly, reconciliation becomes messy, financial statements lose reliability, and tax reporting becomes more difficult.

This is why many growing online stores use ecommerce accounting automation tools to sync clean, structured data directly into their accounting software, reducing the chances of journal entry errors.

Ecommerce Journal Entry Example

A customer purchases a product for $100 plus $5 sales tax and $10 shipping, paid by credit card.

Here’s how the journal entry might look:

| Date | Description | Account | Debit | Credit |

| 07/01/2025 | Sale of RapidZap microwave oven

(Order: 1065) |

Accounts receivable | $115 | |

| Sales revenue | $100 | |||

| Sales tax payable | $5 | |||

| Shipping payable | $10 | |||

| Cost of goods sold | $50 | |||

| Inventory | $50 |

This is a straightforward example of double-entry accounting: every credit has a corresponding debit.

In this case, the store records $115 owed from the customer (Accounts Receivable) and credits the appropriate revenue and liability accounts. COGS and inventory adjustments reflect the cost of the product sold. When the customer’s payment is deposited later (minus any fees), a second journal entry would record the payout.

What Types of Journal Entries Do Ecommerce Businesses Use?

Ecommerce businesses use several different types of journal entries throughout their accounting cycle, each serving a specific purpose:

- Simple entries: one debit and one credit (e.g., paying a monthly subscription).

- Compound entries: multiple debits and credits in one entry, which are common for ecommerce sales involving tax, shipping, fees, and COGS.

- Closing entries: used at period-end to reset revenue and expense accounts.

- Adjusting entries: update or correct account balances before closing the books (e.g., accrual or deferral adjustments).

- Opening entries: carry ending balances, assets, liabilities, and equity into the new accounting period.

- Reversing entries: reverse prior-period accruals to prevent double-counting when the actual transaction posts.

- Transfer entries: move funds between internal accounts (e.g., transferring PayPal or Stripe balances into your bank account).

How to Write a Journal Entry in Ecommerce Accounting

The easiest way to record ecommerce journal entries is to follow a consistent process. Here’s what that looks like:

Step 1: Identify the Transaction

The first step is deciding what type of transaction has taken place. In ecommerce, that could be anything from a sale or bill to a supplier payment.

Differentiating between all the transactions you handle is important. You can tell more easily which accounts you need to debit and credit. For example, online stores need to make a distinction between product sales and gift cards in their journal entries. Vouchers represent a liability rather than immediate revenue until the customer uses them to pay for goods or services.

Step 2: Determine the Accounts Affected

Next, decide which accounts the transaction impacts. Ecommerce businesses typically use all five main categories of accounts:

- Assets: cash, accounts receivable, inventory, prepaid expenses.

- Liabilities: sales tax payable, shipping payable, gift card liability, and loans.

- Expenses: COGS, processing fees, shipping expenses, software, and payroll.

- Revenue: product sales, shipping income, gift card redemptions.

- Equity: owner’s equity, retained earnings.

Most ecommerce transactions affect several accounts at once. Using a Chart of Accounts (CoA) makes this step far easier, as each account has a clear name and code.

Step 3: Record the Debits and Credits

Once you know the accounts involved, assign debit and credit amounts.

A helpful rule is to visualize the cash flow. For example, if you collect $10 in shipping charges that you owe to a courier, you may record:

- Debit Accounts Receivable (asset).

- Credit Shipping Payable (liability).

In ecommerce, it’s rare for a sale to be a simple single-entry. Even a basic order may include revenue, tax, shipping, fees, and COGS.

Most accounting systems, and accounting automation tools like MyWorks, can generate these debits and credits automatically using your mapped accounts. But even if you automate, understanding the logic will help you review your books confidently.

Step 4: Add a Clear Reference

Every journal entry should include a reference, such as:

- Order number.

- Payout ID.

- Invoice number.

- Refund reference.

This makes reconciliation and audits faster and reduces the risk of duplicate entries.

How Do Ecommerce Businesses Manage Journal Entries Using Accounting Software?

Manual bookkeeping works when you’re just starting out, but as your order volume increases, manually entering every sale quickly becomes unmanageable.

Tools like QuickBooks and Xero streamline ecommerce bookkeeping by:

- Tracking and recording transactions.

- Calculating taxes and fees.

- Generating journal entries.

- Producing financial statements.

- Reconciling accounts.

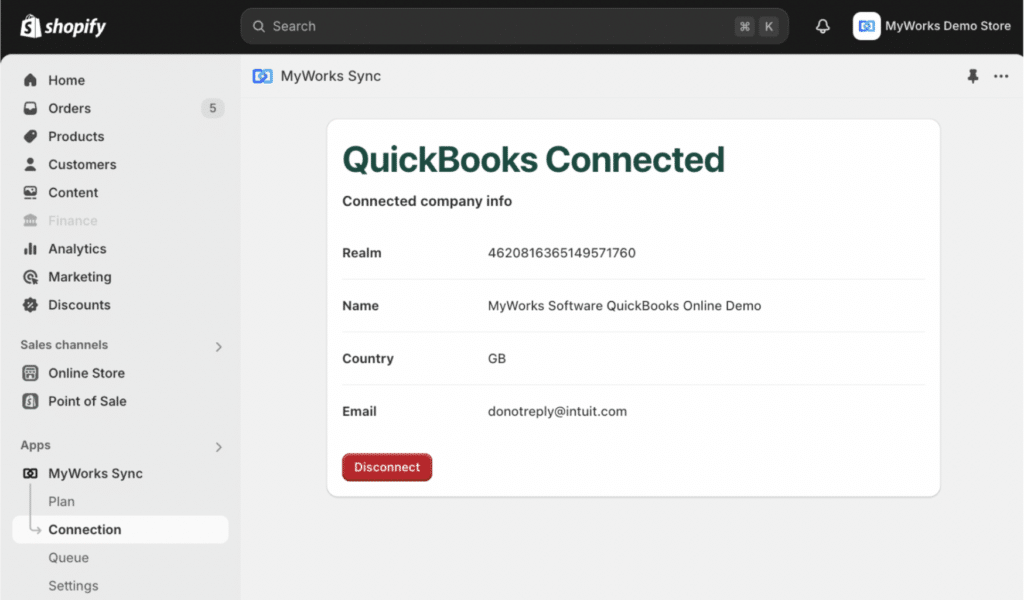

When paired with a sync tool like MyWorks, they become even more powerful. Your ecommerce store sends real-time order, fee, tax, and payout data to your accounting software, which automatically records the appropriate journal entries and updates your accounts.

This ensures your books stay accurate without the repetitive manual work. You can log into your accounting system anytime to review entries, generate financial reports, or prepare tax filings.

Do You Still Need to Understand Journal Entries if You Automate Them?

Journal entries remain a fundamental part of ecommerce accounting, even when software handles them for you. Understanding how they work helps you:

- Troubleshoot discrepancies.

- Review your accountant’s work.

- Interpret your financial statements.

- Understand why payouts don’t always match order totals.

- Make informed decisions about pricing, shipping, and inventory.

That said, you don’t need to create every entry by hand. Modern ecommerce accounting software and integrations like MyWorks can generate accurate entries automatically, so your books stay up to date without burying you in paperwork.

Never Lose Track of Payments AgainMyWorks syncs all your data between popular ecommerce and accounting platforms so your books are always accurate and up to date. |

FAQs About Accounting Entries for Ecommerce Businesses

1. What Are Ecommerce Accounting Entries?

Ecommerce accounting entries are the individual debits and credits that record every financial component of an online transaction, such as revenue, taxes, shipping, fees, discounts, and COGS. These entries ensure your financial statements reflect the real activity happening in your online store.

2. How Do You Record an Ecommerce Sale in a Journal Entry?

You record an ecommerce sale by debiting Cash or Accounts Receivable and crediting Sales Revenue, Sales Tax Payable, and Shipping Income (if applicable). You also debit Cost of Goods Sold (COGS) and credit Inventory to reflect the cost of the product sold.

3. How Do You Record Payment Processor Fees?

Processor fees from Shopify, Stripe, or PayPal are recorded as an expense. Debit Bank for the net deposit, debit Processing Fees for the fee amount, and credit Accounts Receivable or your clearing account for the full order value.

4. What Is the Journal Entry for Ecommerce Refunds?

Refunds are recorded by debiting Sales Returns and crediting Cash or Accounts Receivable. If the product is returned to inventory, you also debit Inventory and credit COGS to reverse the original cost entry.

5. How Does MyWorks Help With Ecommerce Journal Entries?

MyWorks syncs real-time order, tax, shipping, fee, and payout data from Shopify or WooCommerce into QuickBooks or Xero. This automation removes manual data entry, prevents duplicate or incorrect entries, and keeps your books accurate as your order volume grows.