70% of consumers say the choice of payment methods influences where they buy from. That means the payment gateways you use could make or break your online store.

WooCommerce users can find a variety of popular and affordable options via the WordPress dashboard. You can support multiple payment methods to boost the customer experience and make sure they don’t abandon their cart.

We’ve developed this guide to WooCommerce payment gateways to set you up for success. Read on to discover how they work, which ones to use, and all the best practices.

How do WooCommerce payment gateways work?

A payment gateway is software that enables you to accept credit and debit card purchases from customers. Ecommerce stores mostly use an online checkout portal.

Although they serve similar functions, a payment gateway is different from a payment processor. The payment gateway collects and verifies purchase information before connecting the customer to the merchant account. However, it’s the payment processor that initiates the transfers.

On WooCommerce specifically, the payment gateways are WordPress plugins you can download and add to your store. These gateways then integrate with your online store so customers can move seamlessly between your product listings and the checkout.

Alternatives like Shopify offer both built-in and integrated payment methods. However, WooCommerce has no native tools as it’s a WordPress website plugin. You must set up and manage your payment system from scratch. This adds more complexity compared to other ecommerce platforms but ultimately gives you more freedom and control.

What payment gateways does WooCommerce support?

WooCommerce’s flexibility and range of plugins allow it to support many popular payment gateways. Here are the main types:

- Hosted: Redirects the customer to a third party to authorize the purchase

- Self-hosted: Handles the entire process from your WooCommerce site

- API: Integrates directly into your website via an interface

- Local bank integration: Directly connects customers with a local bank

- Mobile payment gateways: Manages card authorization for people paying on a device

If you’re new to website development, it’s best to start with hosted and mobile payment gateways. They require the least setup and management. The tradeoff is that you have to direct customers off-site to make payments.

Most popular providers offer multiple WooCommerce-supported payment gateways. For instance, it’s common for a plugin to have a hosted and an API version.

What do WooCommerce payment gateways cost?

The total cost of WooCommerce payment gateways depends on several factors.

Most providers charge a transaction fee plus a fixed amount. You can expect to pay around 2.9% plus $0.30. They also charge higher rates for special services like instant payments or international transfers.

There may also be a monthly or annual fee for using the software. Prices typically start around $25 per month. If the provider has a subscription, they’re more likely to offer lower transaction fees.

A few providers charge a one-time fee for setting up the software and onboarding your business. Expect to pay around $50 to $200 for this service.

Note that many providers describe themselves as free WooCommerce payment gateways. Most mean they have no subscription or setup fees — there’s still a charge per transaction.

What to look for in payment gateways for WooCommerce

WooCommerce has a variety of payment gateways to suit different business types. Here’s how to narrow down your options:

Cost

Decide which pricing structure works best for your business. A transaction-based model with no subscription fees is often best for small stores. You only pay for the software when you generate revenue so there’s a reduced risk of going over budget.

Whereas an established store may prefer a subscription with lower transaction fees. The money you save on transfers will offset the monthly costs.

Location

Do you have international customers? Some payment gateways only support specific countries so make sure the options you’re considering serve everywhere you need. Check they have all the required currencies as well to avoid paying additional fees for foreign conversions.

Compatibility

Ensure your payment gateway accepts most major credit cards and digital wallets. That way you can offer customers all their preferred methods at the checkout and guarantee they’ll complete the purchase.

Consider your target demographic when deciding which payment methods to prioritize. For instance, the majority of Gen Z use digital wallets. If you have a young customer base, your gateway should have Apple Pay at a minimum.

User experience

Research which options your team has the expertise to set and manage. While a self-hosted payment gateway allows more control, it requires more technical knowledge. Assess whether you have the time to train your team and manage the extra upkeep or whether a hosted version would suffice.

Also, look at each provider’s reputation. Customer reviews and ratings can tell you whether the payment gateway is intuitive and responsive.

Security

Ecommerce stores must adhere to international data laws, namely the GDPR (General Data Protection Regulation). This legislation ensures you protect sensitive customer data like personal details and financial information.

Hosted payment gateways have robust security features built into the software. All you have to do is check they provide SSL encryption, authentication, and PCI DSS compliance.

Other types require more work from the site administrator. You may have to set up security features and monitor compliance yourself.

The top WooCommerce payment gateways

The best payment gateway for WooCommerce for you depends on your specific business context. However, there are some standout options — the following provide all the essential features while ensuring a seamless service.

- WooCommerce payments: As this plugin was designed by WooCommerce, it integrates smoothly with its other features. You can handle your gateways from the main dashboard rather than the plugin tab.

- PayPal: Still the number one payment software, PayPal offers both a hosted payment and an API gateway. It mostly charges per transaction but a few versions also have a monthly subscription.

- Stripe: This plugin lets you keep customers on your website to complete the transaction. Compared with alternatives, it’s also more developer-focused, meaning you can adapt the tool more easily to your exact needs.

- Square: If you own a physical store, Square is a good option for you. The platform offers a range of software features and equipment so you can build a cohesive system.

- Authorize.Net: One of the most robust WooCommerce payment gateways, this plugin lets you offer a variety of methods and detect fraud.

For a more detailed analysis, check out our WooCommerce payment gateways comparison.

Setting up WooCommerce payment gateways

Once you’ve chosen a platform, here are the typical steps to set up WooCommerce payment gateways.

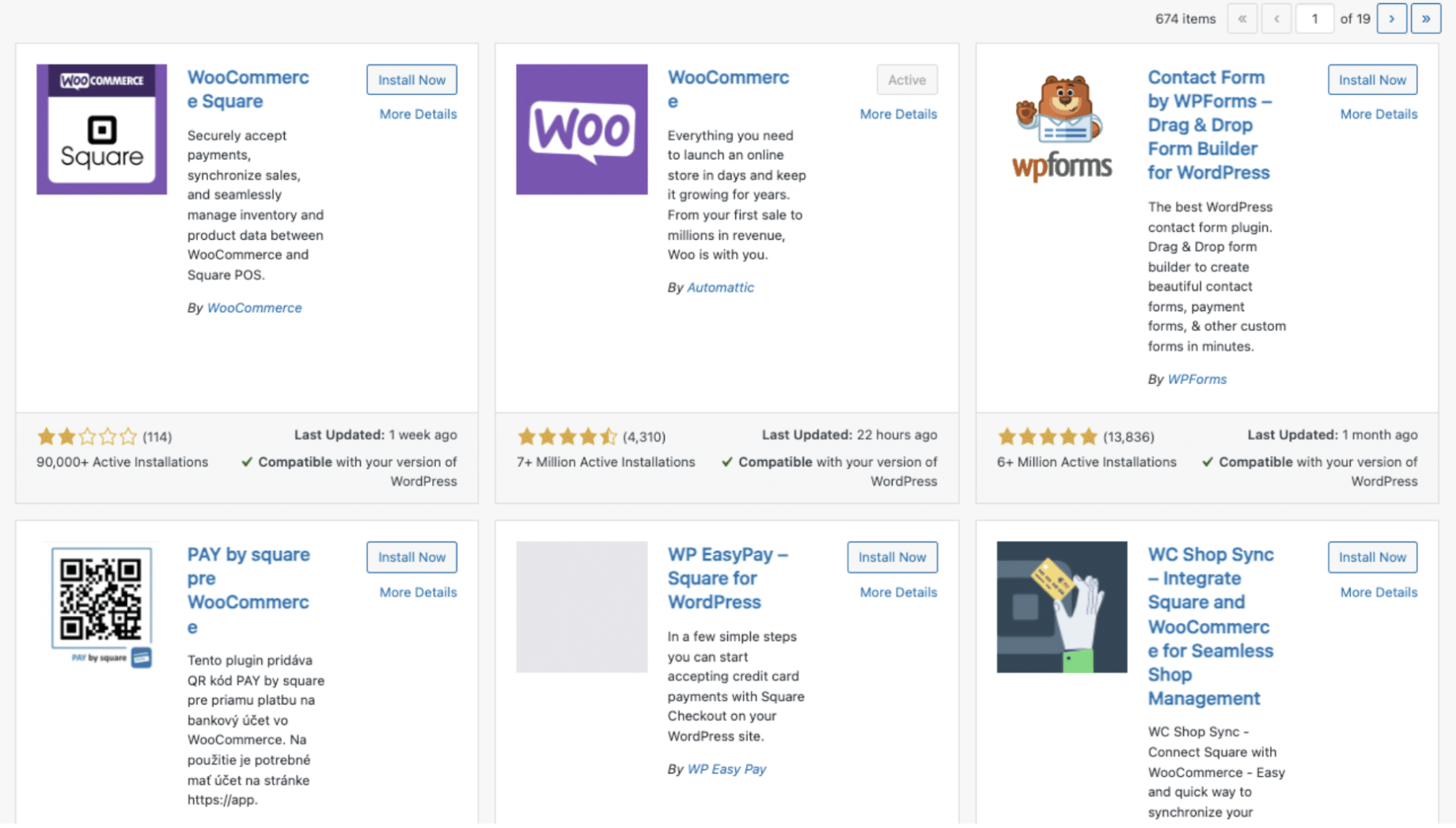

Step 1. Install your chosen WooCommerce plugin

Find the payment gateway you want from the WordPress plugin marketplace. Click ‘install now’ and then ‘activate’ to add it to your dashboard.

Step 2. Connect the plugin

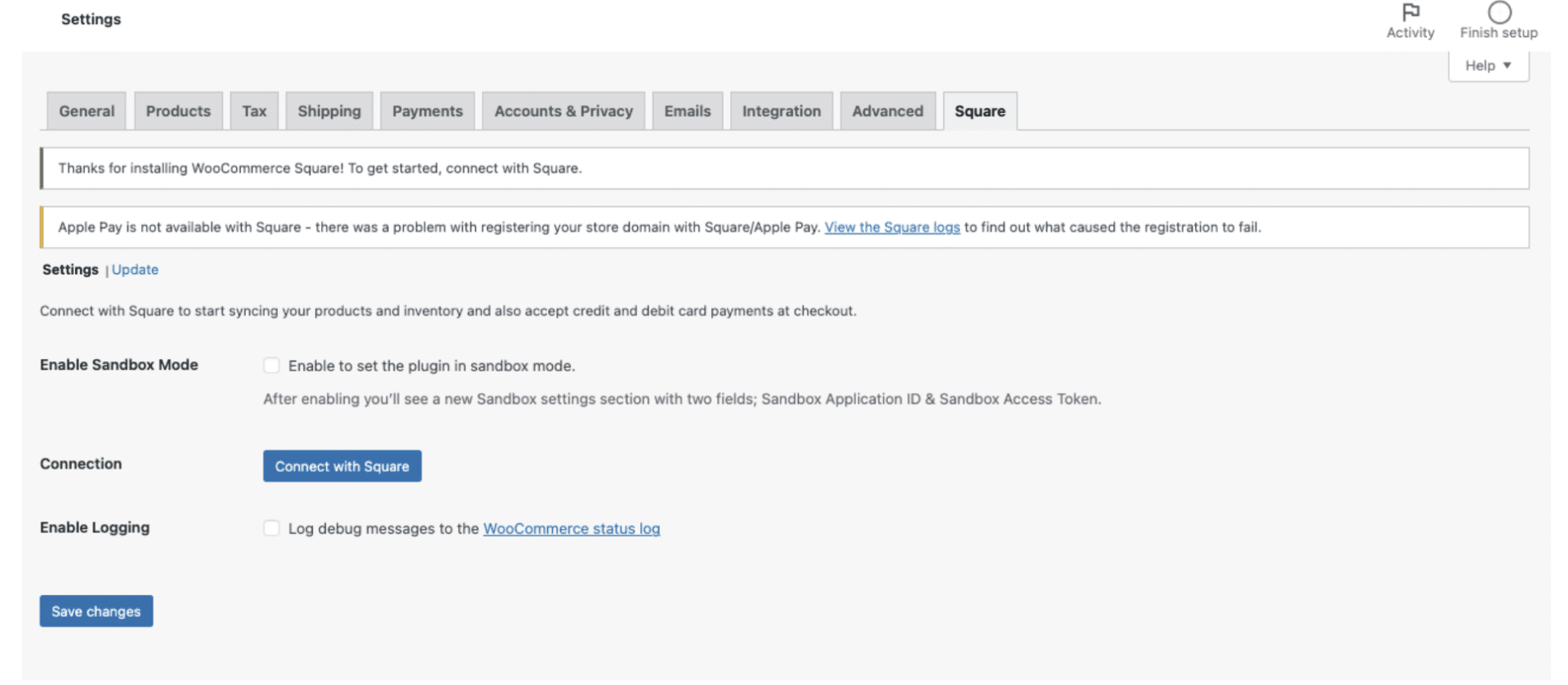

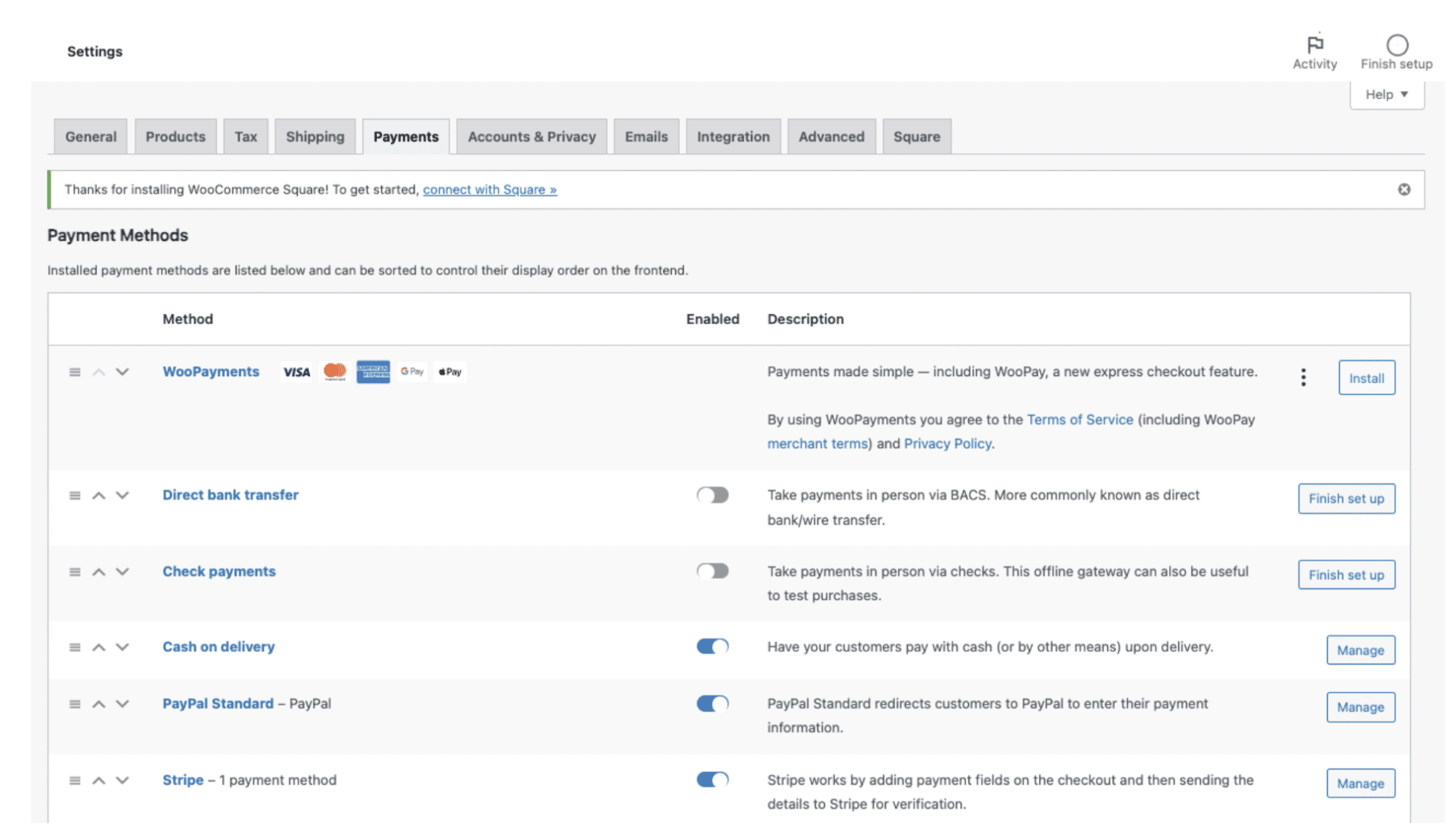

Once installed, the payment gateway will appear on your list of WordPress plugins. You also get a notification.

Click on the notification and WordPress will redirect you to WooCommerce settings. Then click ‘connect’ to link your store and payment gateway accounts. If you haven’t already signed up for the plugin, it’ll prompt you to do so.

WordPress will ask for access to the plugin and permission to modify orders. Click ‘allow’ and you’ll get redirected back to WooCommerce.

Step 3. Configure your plugin sync

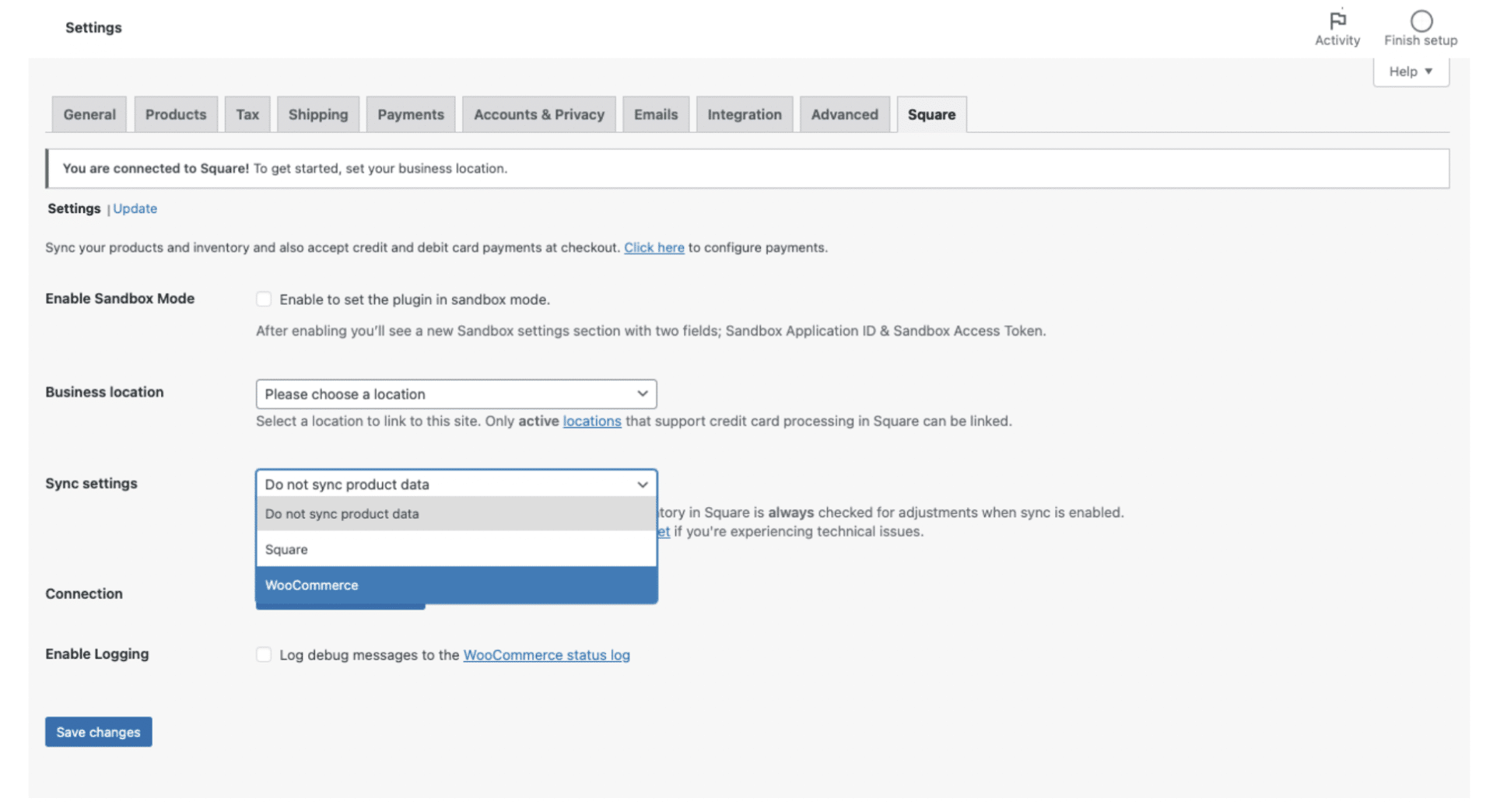

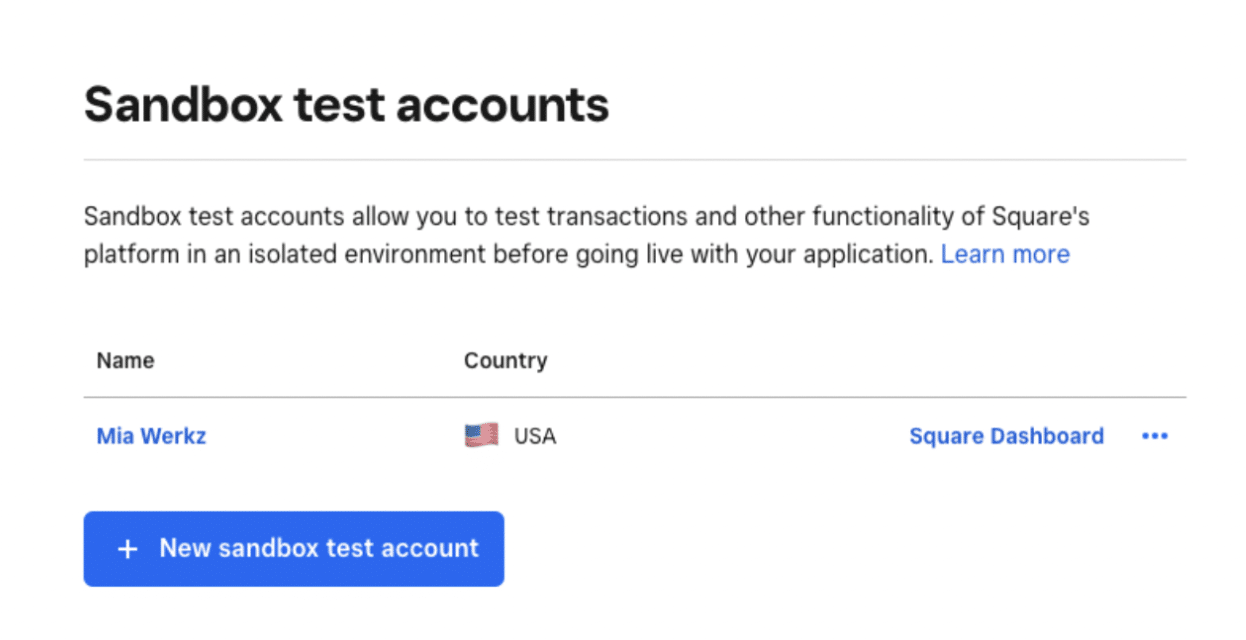

Turn on sandbox mode while you configure settings. You can set up and catch issues before you process real-life transactions.

Then choose how you want to sync your store data. You can select whether to update WooCommerce or the plugin from the drop-down menu.

You can then decide whether to push data to your payment gateway and how often to sync. That means WooCommerce and the plugin can update each other about orders and inventory changes.

Step 4. Customize your plugin settings

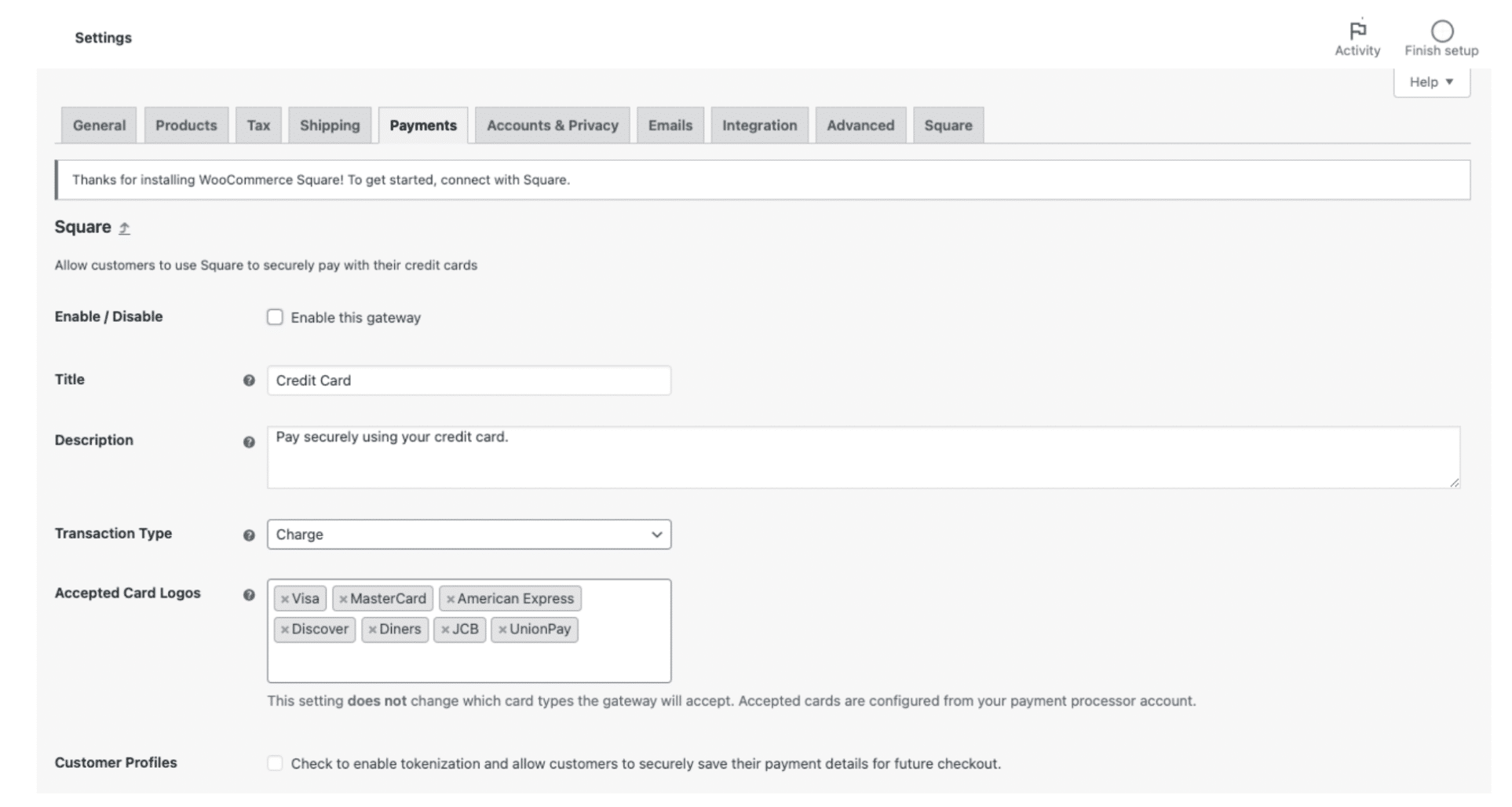

Go to the payment settings in your WooCommerce dashboard. Scroll to the payment gateway and click ‘manage’.

You can configure settings like:

- Field names

- Text and formatting

- Accepted card types

- Gift cards

- Automated messaging

Step 5. Test the plugin

Payment gateways often offer a sandbox environment where you can explore the features and test transactions. There’s no risk of any changes to your store.

You have to leave WooCommerce and sign into the plugin to perform these checks. Afterward, the exact steps depend on the specific payment gateway you’re using.

Step 6. Go live

When you’re ready to accept purchases, first turn off sandbox mode. Then go to the payments tab in your WooCommerce dashboard and enable the plugin.

Managing WooCommerce payment gateways

Once you’ve set up your payment gateway, here’s how to ensure you keep getting the most out of it and avoid issues.

- Regularly review the plugin to check you’re getting the intended results, especially in the first few weeks

- Optimize your site to ensure poor results aren’t due to slow loading speeds causing customers to abandon orders

- Train any staff how to use all the features so there’s always likely to be someone available to fix issues

- Keep the plugin updated to avoid patches in security and bugs in the payment system

- Regularly test transactions to check you can still offer a seamless checkout experience

- Ensure ongoing compliance with all relevant data regulations

Handling multiple WooCommerce payment gateways

Offering multiple payment gateways on WooCommerce can increase sales. Customers are more likely to find their preferred payment method and finish checkout.

The trick is finding the balance. If you have too many payment gateways, you may overwhelm customers with options and deter them from making a purchase. Research your target audience to see which methods are popular among those demographics.

To give you a general idea, a recent report showed that debit card payments are the most common by a large margin. Credit cards and PayPal are next. A small but significant minority still use direct bank transfers.

Managing multiple payment gateways on WooCommerce makes it harder to track purchase information. Store owners say the lack of consistency between providers is a key challenge.

Configuring your settings and using the right plugins can simplify payment management. Here’s how:

Make the most of built-in WooCommerce settings

Manage your payment gateways via the centralized WooCommerce dashboard instead of checking them individually.

If you navigate to the orders dashboard, you should see the payment gateway. You can filter the database by searching for specific ones. The WooCommerce payment statuses give you a quick idea of whether there are any issues like delays or failed payments.

Read our article on WooCommerce automation tools and plugins for more ideas on how to streamline your store management.

Allow subscriptions and recurring payments

See if you can offer subscriptions or recurring payments for certain products. If you can automate billing, you’ll spend less time navigating different plugins. Customers may also appreciate this extra service.

WooCommerce Subscriptions lets you set up and manage repeat payments for your store. The plugin integrates with over 25 payment gateways. You only have to use one dashboard to set schedules and notifications, regardless of where purchases come from.

Set up conditional payment gateways

Set triggers to hide payment methods from customers based on their account and cart details. The WooCommerce Conditional Payment Gateways plugin allows you to do this.

Here are the fields you can set triggers for:

- Billing and shipping location

- Cart total (more or less than)

- Date and time

- Language

- Currency

- User or customer IP

You can filter out irrelevant or unpopular options across locations, simplifying the checkout process. Customers can quickly find the right payment method for them. They’ll be more satisfied with your store and less likely to use poorly supported methods that lead to issues.

Use an ecommerce accounting sync

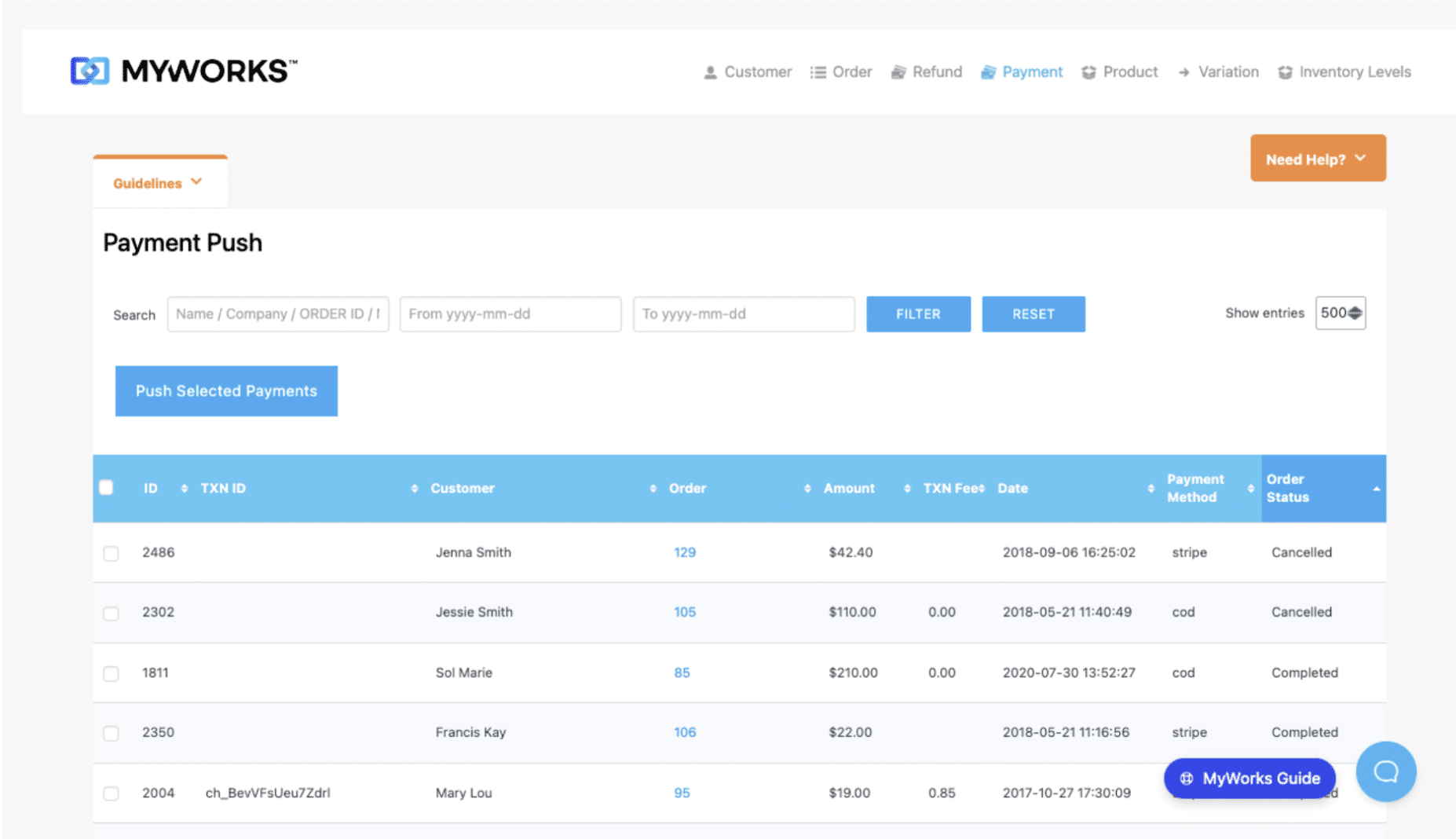

Guarantee you’ve recorded all your purchase information correctly with an ecommerce accounting sync like MyWorks. You can easily transfer data to your bookkeeping platform, leaving less room for errors from manual data entry.

Look for a sync with a range of customization options so you don’t lose track of your payment gateways. For example, MyWorks allows you to easily customize each field in sales that you sync to QuickBooks, resulting in accurate data just as if you had entered it yourself.

Ensure every cart makes it through checkout

Choosing the right WooCommerce payment gateways is crucial for success. You can only count on making sales if you offer great customer experience with a straightforward checkout process.

Multiple payment gateways can enable you to cater to every customer preference. You might be concerned that having multiple payment methods may complicate financial management. That doesn’t need to be the case! With a powerful integration like MyWorks, you can easily sync all your sales data over to your accounting tool, regardless of the number and type of payment gateways you use.

| Keep your WooCommerce store organized with MyWorks

MyWorks syncs all purchase details into QuickBooks or Xero and lets you configure data according to your workflow. |